CAF Laboratory: Driving Financial Inclusion in Latin America

In the last ten years, Latin America has witnessed a revolution in the way financial transactions are carried out. The exponential growth of fintech has driven greater adoption of digital financial services in the region. Among the prominent figures in this panorama, Osvaldo Giménez, president of Mercado Pago, has highlighted the rapid advance of these technologies and their impact on people's lives.

Explosion of Fintechs in Latin America

Over the last decade, Latin America has experienced an explosion in the number of fintechs, companies that offer innovative, technology-based financial solutions. This phenomenon has been driven largely by the growing adoption of mobile devices and the Internet in the region. Fintechs have democratized access to financial services, allowing a larger portion of the population to transact, save and invest more conveniently and affordably.

Osvaldo Giménez, president of Mercado Pago, has been a leading figure in this change of financial paradigm. Mercado Pago, the digital payments platform belonging to the e-commerce giant MercadoLibre, has played a crucial role in promoting digital financial services in Latin America. Its platform has facilitated the adoption of digital payments and financial inclusion in the region, allowing people to transact online safely and efficiently.

Fintechs in Latin America are working hard to develop technological solutions that guarantee the security, speed and efficiency of financial transactions. These companies are leveraging artificial intelligence, machine learning and other emerging technologies to create innovative platforms that meet the changing needs of consumers and businesses in the region.

Growth of the Fintech Sector

The growth of the fintech sector in Latin America is impressive. In just three years, the number of fintech companies in the region has increased by a staggering 112%. Even more notable is that 40% of these companies are led by women, demonstrating greater diversity in the fintech space.

The attractiveness of the fintech sector in Latin America does not go unnoticed by investors. In 2021, fintechs in the region led the number of venture capital investments, capturing 39% of the total amount invested in Latin America. This investment means that the sector is mature and ready to continue innovating and growing in the coming years.

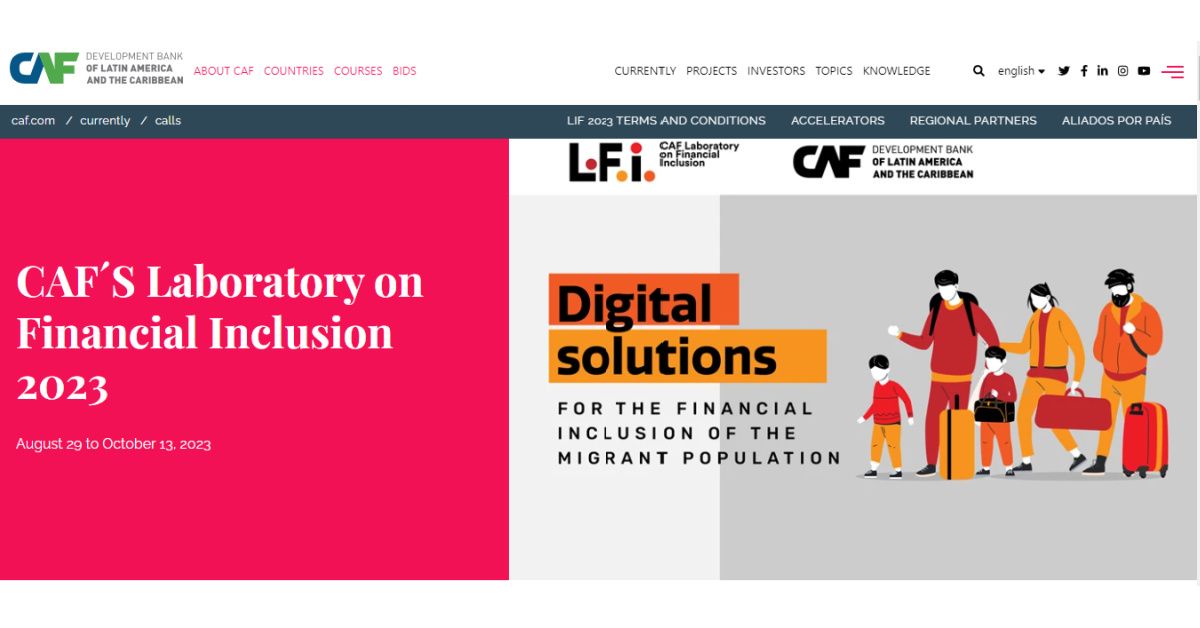

Financial Inclusion Laboratory (LIF 2023):

In addition to the mentioned advances, it is important to highlight the initiative of the Financial Inclusion Laboratory (LIF) organized by the Development Bank of Latin America and the Caribbean (CAF). The LIF 2023 aims to support technological solutions that improve the financial inclusion of the migrant population in the region.

The key dates for this challenge are the following:

- Project submission period: From August 28 to October 13, 2023 at 11:59 p.m. Colombia time.

- Project review: From October 16 to November 22, 2023.

- Announcement of shortlisted proposals: November 30, 2023.

- Pitch presentation and matchmaking event: December 13, 2023.

- Acceleration activities by Seedstars and Endeavor: From January 16 to May 16, 2024.

The rise of fintechs in Latin America has transformed the way people interact with the financial system. Mercado Pago and other innovative companies are leading this change, providing technological solutions that improve the lives of the population in the region. As the fintech sector continues to grow and attract investment, we can look forward to an exciting future of greater financial inclusion and more technological innovations.