Discover the Latest in Mexico's Fintech Ecosystem with Finnovista's Report

In collaboration with Visa, Finnovista has crafted the eighth edition of the Finnovista Fintech Radar Mexico. The ultimate goal of this Radar is to provide a comprehensive picture of the FinTech ecosystem in the country, shedding light on startups, their innovations, solutions, and prevailing trends within the sector.

Evolution of The Mexican FinTech Ecosystem

Information for this study has been gathered through responses from over 380 FinTech companies in Mexico, interviews with various ecosystem stakeholders, and an analysis of specialized sources by Finnovista's Innovation team.

By the end of 2023, the Mexican FinTech ecosystem had reached a milestone with a remarkable 18.9% growth in the number of local ventures compared to the previous year, totaling 773 local startups. This sustained growth demonstrates the resilience of the sector, which has maintained a compounded growth trend of 18.4% over the past five years.

Segment Distribution

In 2023, nearly all FinTech segments experienced significant growth, except for Crowdfunding, which saw a slight decline. Segments such as Lending, Payments and Remittances, Enterprise Financial Management, and Enterprise Technologies for Financial Institutions emerged as the most prominent FinTechs in terms of presence and project numbers within the ecosystem.

Some standout FinTech solutions in 2023 were Proptechs focused on the real estate sector, SaaS-based Enterprise Financial Management, lenders specializing in the "Buy Now, Pay Later" model, and Open Finance companies specializing in Embedded Finance.

Economic Landscape

Mexico's GDP grew by 3.2% in 2023, surpassing the global estimates by the International Monetary Fund (IMF) of 3%. However, a slowdown is projected for 2024, with an estimated growth of only 2.1%, influenced by factors such as capacity constraints and restrictive monetary policies.

The rise in interest rates in 2023, driven by the Bank of Mexico to curb inflation, has led to fierce competition to attract new customers through savings products. This "Rate War" has prompted some FinTechs to offer interest rates of up to 17%, while a gradual decrease in rates is expected for 2024.

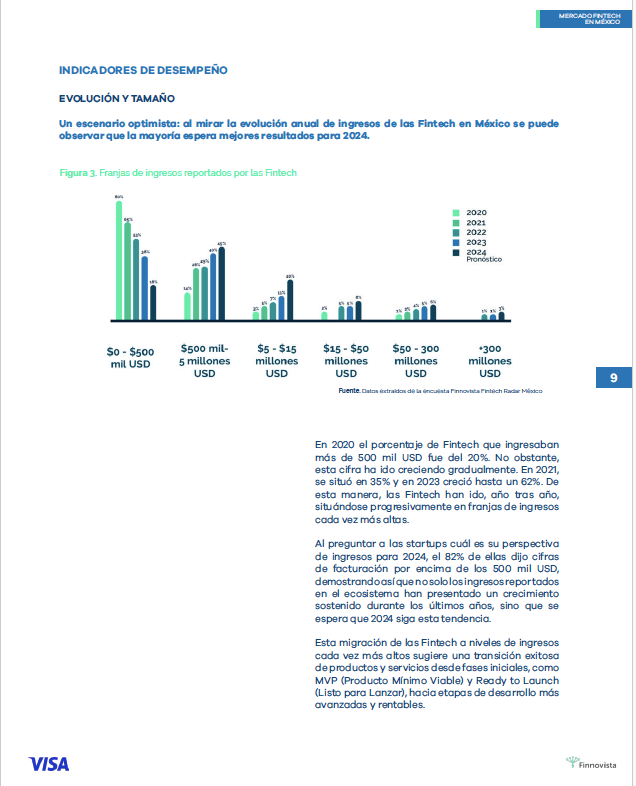

Revenue and Development Outlook

The continuous growth in reported revenues by Mexican FinTechs is evident, with 82% of surveyed companies projecting revenues exceeding $500,000 USD by 2024. This migration to higher revenue levels suggests a successful transition of products and services to more advanced and profitable stages of development.

The primary challenge for FinTechs in 2024 is scalability and internationalization, with 55.8% of respondents identifying this aspect as their main challenge. However, there is an increase in collaboration between FinTechs and financial institutions, as well as a focus on the development of advanced cybersecurity and fraud prevention services.

Investment and Venture Capital

Although total investment in Mexico experienced a year-on-year decline of 42.6% in 2023, it remains an attractive market for investment, with a transactional value of $1.688.1 billion USD in the first three quarters of the year. Regarding venture capital, there was a 49.1% decrease compared to the previous year, though it remains a significant source of funding for startups.

The FinTech ecosystem in Mexico shows solid and continuous growth, with an increase in the number of projects, revenues, and collaborations with financial institutions. Despite present challenges such as the rate war and the decline in venture capital investment, the sector remains on a positive trajectory, driven by innovation and adaptation to new economic and technological realities.

To read the full report, click here.