Explore the Key Challenges Facing Fintechs in Mexico

The recent report from Finnovista Fintech Radar Mexico VIII Edition reveals light on the persistent challenges in Mexico regarding banking and financial services adoption. Despite ecosystem endeavors, achieving widespread banking remains a considerable challenge, as evidenced by 44.6% of Fintech products and services catering to underbanked or unbanked segments. This data indicates that there are still numerous individuals and businesses in Mexico without access to traditional financial services.

Role of Fintech in Banking

Fintechs have proven to be fundamental allies in the banking and digitalization process in Mexico. Through their innovative solutions, these companies are reaching segments of the population that previously lacked access to financial services. However, despite ecosystem efforts, financial inclusion figures have remained virtually stagnant for several years, according to the National Financial Inclusion Survey (ENIF).

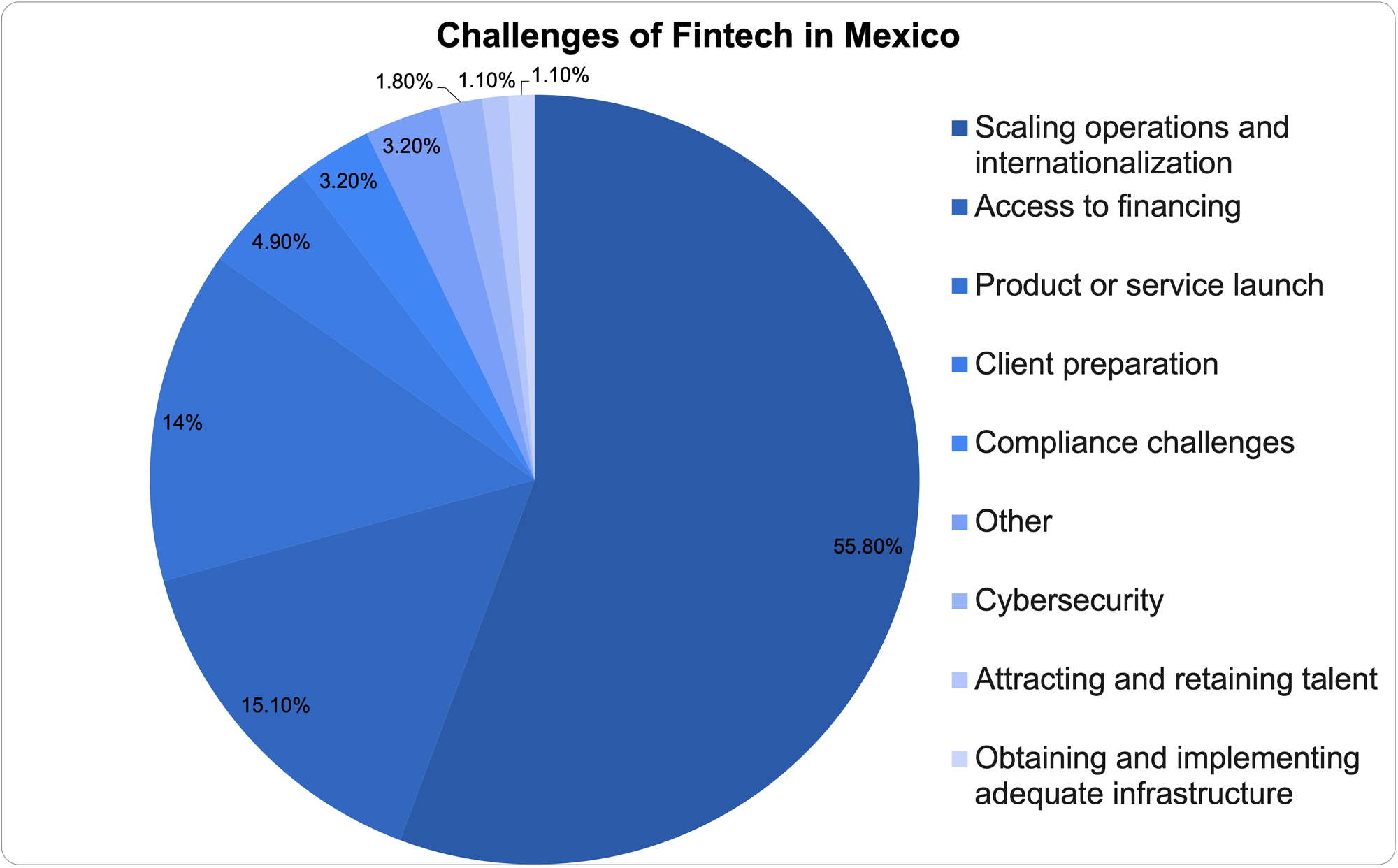

The study also identifies the main challenges facing Fintech in Mexico. 55.8% of surveyed companies cited scalability of operations and internationalization as their main challenge for 2024. This is partly due to the maturity of the Mexican market and limited access to financing to support growth in new products or services.

Another significant challenge identified by Fintech is access to financing, albeit to a lesser extent than operational scalability. Despite lower venture capital investment in recent years, most surveyed companies still have resources, albeit managed more cautiously.

Gender Gap in Executive Positions

In terms of gender diversity, the report highlights that only 28.9% of executive positions in Mexican Fintech are held by women. This figure reflects an ongoing challenge in gender equity in the sector, with a similar percentage in other Latin American regions such as Argentina and Peru.

Despite advances in the Fintech sector, banking and financial inclusion remain significant challenges in Mexico. To address these challenges, it is necessary to continue promoting innovation, collaboration between the ecosystem and traditional actors, and financial education. Additionally, it is essential to work on reducing the gender gap in executive positions to ensure equitable representation in the financial sector.

To read the full report, click here.