Top 5 Neobanks in Colombia in 2023

Although traditional banking continues to be the main channel of operations, more and more Colombians are turning to alternatives such as neobanks to carry out their transactions.

Although traditional banking continues to be the main channel of operations, more and more Colombians are turning to alternatives such as neobanks to carry out their transactions.

According to the Bogotá Chamber of Commerce, this new sector represents a novel option in current financial services, it is fully digital entities that were created to function in a technological ecosystem that does not need physical branches.

Although the term neobank does not formally exist in Colombia, some of the entities that already provide services in the country can be grouped within its definition; and more and more financial players are making their way in this segment.

Some of the entities that have led the neobank boom in recent years have been: Daviplata and Nequi, companies that, together, would exceed 30 million users in the region. Given this, we present the Top 5 of the Neobanks with the most number of clients in Colombia.

Daviplata

This platform went from 14 to 16 million customers in 2022 after opening operations in Honduras. With this application, users will have an easier, faster and safer option to transfer money from one cell phone to another and from anywhere in Colombia. That is, DaviPlata is a product that allows you to make various transactions only by activating its application.

Nequi

After the Financial Superintendence of Colombia authorized its separation from Bancolombia, this digital bank managed to increase the number of users from 10 to 15 million in 2022. According to its managers, the goal is to help people solve their day-to-day lives with the functionalities in money management, payment services and loans, since every day, on average, 550,000 users send or receive money from Nequi to Nequi through the application.

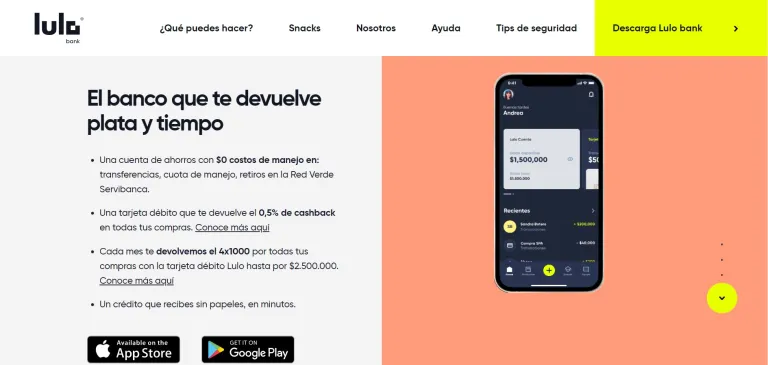

Lulo Bank

Lulo Bank, owned by the Gilinski family's Gilex Holdings, joined the neobank era in July 2021, and has since begun an accelerated process of registering more Colombians on its list, who can access a savings account with zero handling fees, a debit card that returns 0.5% cashback on all purchases and, in addition, returns 4×1,000 every month for movements of up to 2,500,000 pesos.

Nu

Another of the largest companies in the region is Nu, which, with its operations in Mexico, Brazil, Argentina and Colombia, already has 48 million users. One of the great milestones that has propelled this neobank was the ringing of the bell that announced its entry into Wall Street, raising US$2.6 billion in an American Initial Public Offering (IPO). In accordance with his vision, Un created technological tools to free more and more Colombians from financial complexity and improve their quality of life.

RappiPay

Financial entity with which you can manage and control your money safely, without paperwork, 100% digital and all from the Rappi App.

From the application you can: send and collect money, transfer to any bank in Colombia, pay public services and/or bills, withdraw cash at any Davivienda ATM in the country. All this and more, without cost or commissions.

Regulation in Colombia for entities with digital services

Although the term "neobank" is not regulated in the coffee country, Congress approved in 2019 a fast track of conditional licenses for companies that offer digital financial services. These entities can obtain a temporary operation certificate, with minimum capital and requirements. In this way they can start operating quickly with the license issued by the Financial Superintendency.