Venture Capital in Latin America: The Essential Insights from Cuantico's Latest Report

Cuantico, recognized as a leading Research and Broadcasting Firm for the Venture Capital Industry in Latin America, is dedicated to supporting the growth of the region's venture capital sector. Their mission is to expedite Latin America's advancement and stimulate innovation within the industry.

Cuantico proudly introduces the second edition of the Latin America Venture Capital Report 2023, a comprehensive executive analysis that outlines prevailing industry trends across the region's key markets. Gratitude is extended to valued partners Startuplinks, Startups Latam, and CAFI for their contributions to the report's launch, preparation, and dissemination.

Context of Venture Capital in Latin America

In 2023, Latin America faced a significant downturn in venture capital investment, marking its lowest volume in the last five years. Startups attracted $2.78 billion, an 84% decrease from 2021 and a 65% decrease from 2022, signaling a dynamic shift in the funding terrain.

Latin America saw 742 funding rounds in 2023, totaling USD$2.78 billion, with a median deal size of USD$1 million. The landscape witnessed 326 mergers and acquisitions and one initial public offering as part of annual exits.

The venture capital industry in Latin America showcased diverse trends. Significant sectors included HealthTech (4%), RetailTech (3%), Energy (4%), Fintech (33%), FoodTech (6%), and others (45%). Brazil led with a volume of USD$1.634 billion, followed by Mexico (USD$450 million), Central America (USD$90 million), and Chile (USD$225 million).

In 2023, angel investments in Latin America totaled USD$530.46 million, witnessing a significant drop. Contrarily, early-stage investments reached or exceeded pre-pandemic levels, totaling USD$1.116 billion.

Highlighted Aspects of the Report

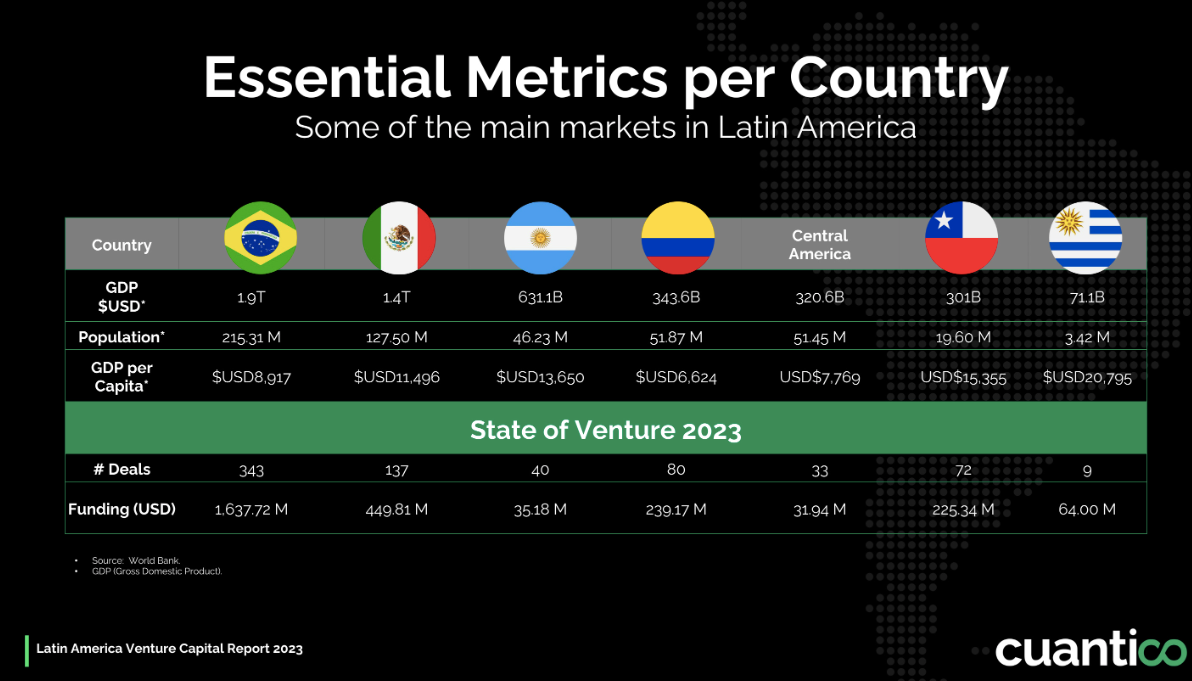

Prominent markets in Latin America, including Brazil, Central America, and Colombia, displayed varying GDPs, populations, and venture capital deals and funding. Notably, despite an overall decline in venture capital investments, certain markets, such as Central America, Uruguay, and Chile, reported higher figures compared to the pre-pandemic period.

Latin America has 585 VC investors, characterized by a median fund size of USD$10 million, a USD$50,000 median minimum ticket size, USD$250,000 median maximum ticket size, and a USD$10 million median maximum cap or valuation per investment. Investor distribution is concentrated in Brazil (58%), followed by Mexico (8%), Chile (5%), and Central America (1%).

2024 Perspectives

As Latin America navigates the aftermath of a challenging 2023, the venture capital landscape is poised for a revival in 2024.

David Alvo representing of Impacta.VC, forecasts a pivotal turning point for startups, stating: "This will be the last tough year for startups. Many founders will have to shut down or keep their companies operating minimally; and other startups will emerge victorious in the few markets that will grow exponentially in 2024. What is certain is that this generation of founders will have a learning experience like no other, and in the next industry boom, we will produce unicorns like never before."

Junior Rodrigues representing Abstartups shares insights on Brazil's outlook for 2024, stating: "For 2024, the forecast for Brazil is to resume investment rounds with a slight improvement, especially in series beyond the initial stage, due to greater market stability. With investor confidence on the rise, we believe there will be growth in more robust investments (Series A, B, C). In the pre-seed and seed stages, despite the market contraction in 2023, there was a significant volume of investments, and we believe this trend will continue in 2024."

Nicole Schaub representing CAFI.VC states the following: "It is important to understand that the dynamics of venture capital in Latin America and Central America will present challenges and opportunities. Compared to 2023, some Central American markets show growth potential. The key lies in promoting the existence of new VC funds and diversifying sectors for the sustainable development of the industry in the region."

Bernardt Vogel from VU Ventures shares an optimistic outlook, stating: "As a venture capital investor in Latin America, I see encouraging signs for the industry in 2024, despite the slowdown of the last two years. While global economic uncertainty still generates caution in later rounds. I anticipate a rebound in early investments in innovative startups in the region. The Latin American entrepreneurial ecosystem has shown great resilience and potential for solving local problems with scalable solutions."

Jaime Matus representing Cacao Capital offers insight stating,: "2024 will be a year that continues to mark the world of venture capital, where some funds, due to a lack of liquidity events and distribution, will face challenges in raising their next funds. Investor pressure for liquidity will be much stronger, and the discipline of capital mobilization and investment in early-stage startups will be much more rigorous. With many countries going through electoral cycles, we anticipate greater uncertainty in the markets and geopolitical frictions, which will exacerbate bias and caution in the ecosystem and market."

Victoria Garcia Besne, representing Iluminar, emphasizes, "Gazing into 2024, it's crucial to recognize the diverse challenges confronting the venture capital ecosystem. These include the overvaluation of companies in portfolios, a shortage of viable exit channels, performance concerns, fundraising difficulties, and a noticeable lack of diversity. The era of unlimited access to capital has reached its conclusion. These shifts will significantly affect VC funds, underscoring the pivotal roles of diversity and value creation for investors. This creates a challenging environment for both funds and entrepreneurs alike."

Claudio Barahona of Ayala Capital provides insights into the macroeconomic landscape, stating, "From a macroeconomic perspective, 2023 posed challenges for Latin America. However, in the closing months of the year, positive developments emerged, marked by a decline in inflation (excluding Argentina, a consistent outlier in these assessments), and an anticipated gradual reduction in interest rates. Consequently, as we enter 2024, our countries are expected to shift into recovery mode.."

Israel Garcia of Startuplinks predicts: "This 2024, we are going to experience a tangible change in the way Venture Capital has been done in Latin America. Something we will see is the consolidation of impact investment, consolidation of investment in profitable business models, and growth of investment from VC funds outside of Latin America, investing again in the region."

Macarena Liu from Driven shares insights, expressing:"The venture capital industry operates in cycles, and after undergoing two years of substantial contraction, we are now witnessing gradual signs of recovery. I anticipate that 2024 will mark a notable improvement, characterized by increased capital deployment from funds that have been patiently awaiting robust opportunities with solid business fundamentals. The prospect of lower interest rates further enhances the positive outlook for this asset class, fostering my optimism about what lies ahead."

Jose Kont from Cuantico highlights the following: "Despite the usual optimism that characterizes the venture capital industry, 2023 was a particularly challenging year. Witnessing the lowest venture capital investment volume in the past five years, both investors and startup founders experienced a prolonged downturn, which seems far from over."

Challenges and Opportunities

To encourage venture capital investment in Latin America, the region needs more VCs. A harsh contrast is evident when comparing the United States, with one venture capital fund for every 26,800 people, to Latin America's ratio of one venture capital fund for every 1.1 million people, excluding Brazil, Chile, and Mexico. The need for more startups is also emphasized, with considerable gaps in the number of individuals per VC-funded startup in various Latin American countries

Despite the challenges faced in 2023, Latin America remains resilient, ready to approach 2024 with strength. The lessons learned are expected to contribute to the region's growth, particularly with the optimization of traditional sectors using AI.

If you want to read and explore the report, click here.

For further inquiries, contact Cuantico at info@cuanticovc.com.