DGF and Quartzo Lead US$ 3M Investment in Takeat to Scale AI Tools for Restaurants

Takeat raises approximately US$3 million in a Series A led by DGF and Quartzo Capital to expand its AI-powered restaurant management SaaS across Brazil.

Takeat, a Brazil-based startup specializing in SaaS solutions for restaurant management, has raised US$3 million in a Series A funding round to accelerate its national expansion and strengthen its technology platform. The company aims to triple its client base and significantly increase its presence across the country over the next year.

The round was led by DGF and Quartzo Capital, with resources structured through the Espírito Santo Sovereign Fund (FUNSES1). The capital will be allocated to commercial expansion, marketing initiatives, product development, and strategic partnerships.

Currently serving approximately 3,000 restaurants, Takeat plans to scale well beyond this mark, targeting up to 13,000 restaurants on its platform as part of its next growth phase.

Growth momentum amid shifts in Brazil’s delivery market

According to CEO Miguel Carvalho, the timing of the Series A aligns with structural changes in Brazil’s food delivery ecosystem. The entrance of new platforms such as Keeta and 99Food is reshaping the competitive landscape and opening new opportunities for technology providers that support restaurants behind the scenes.

Over the past 15 months, Takeat has recorded 200% growth, reflecting strong demand for integrated digital solutions in a sector traditionally characterized by fragmented systems and operational inefficiencies.

AI-powered SaaS platform for restaurant operations and customer growth

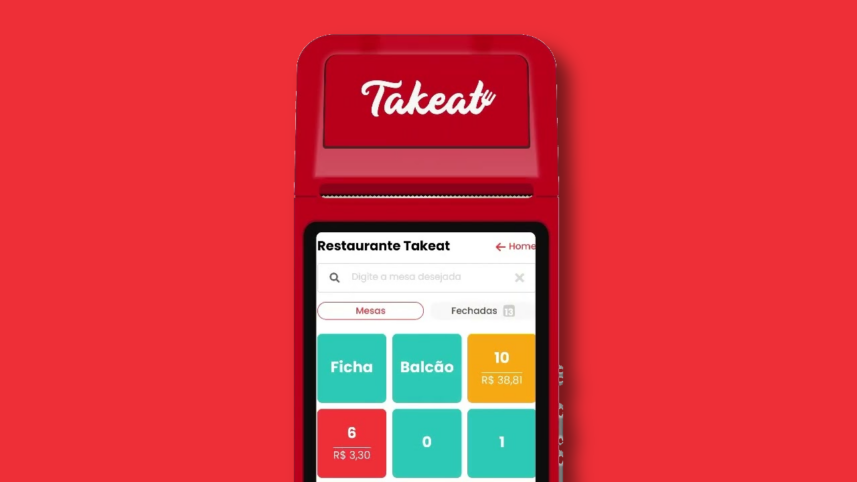

Takeat’s SaaS platform combines artificial intelligence tools to help restaurants improve customer acquisition and retention, optimize financial management, and increase operational productivity. The company’s core value proposition is to centralize and connect essential software and services within a single proprietary platform.

“Our thesis is to become the HubSpot for restaurants: a unified platform capable of integrating, end-to-end, the main technologies used by the sector,” said Miguel Carvalho. “Digitized restaurants are more profitable, but it is not viable for business owners to contract, implement, and operate multiple isolated technologies.”

Globally, comparable models include Toast, the U.S.-based restaurant technology company that went public in 2021 and is currently valued at around US$18 billion. In Brazil, startups such as Opdv, Zak and Saipos, the latter backed by iFood, also operate in this segment and have raised venture rounds.

DGF 8 strengthens B2B software thesis with fourth investment

The Takeat deal represents the fourth investment from DGF’s eighth fund, DGF 8, launched in the first quarter of 2025. The fund has already raised more than R$200 million and maintains a long-standing investment thesis focused on B2B software since 2001.

Marcelo Wolowski, Head of Venture Capital at Quartzo Capital, emphasized the strategic importance of continued support for local companies.

“In addition to reaffirming our commitment to innovation in Espírito Santo, we highlight Miguel’s ability to attract additional investors to the regional ecosystem,” he stated.

The round received financial and strategic advisory from VPx and legal counsel from Varella, Dall’Orto & Malek Associados and Baptista Luz Advogados.