Grupalia Raised US$4.8M in Pre-Seed Round to Digitize Group Lending in Mexico

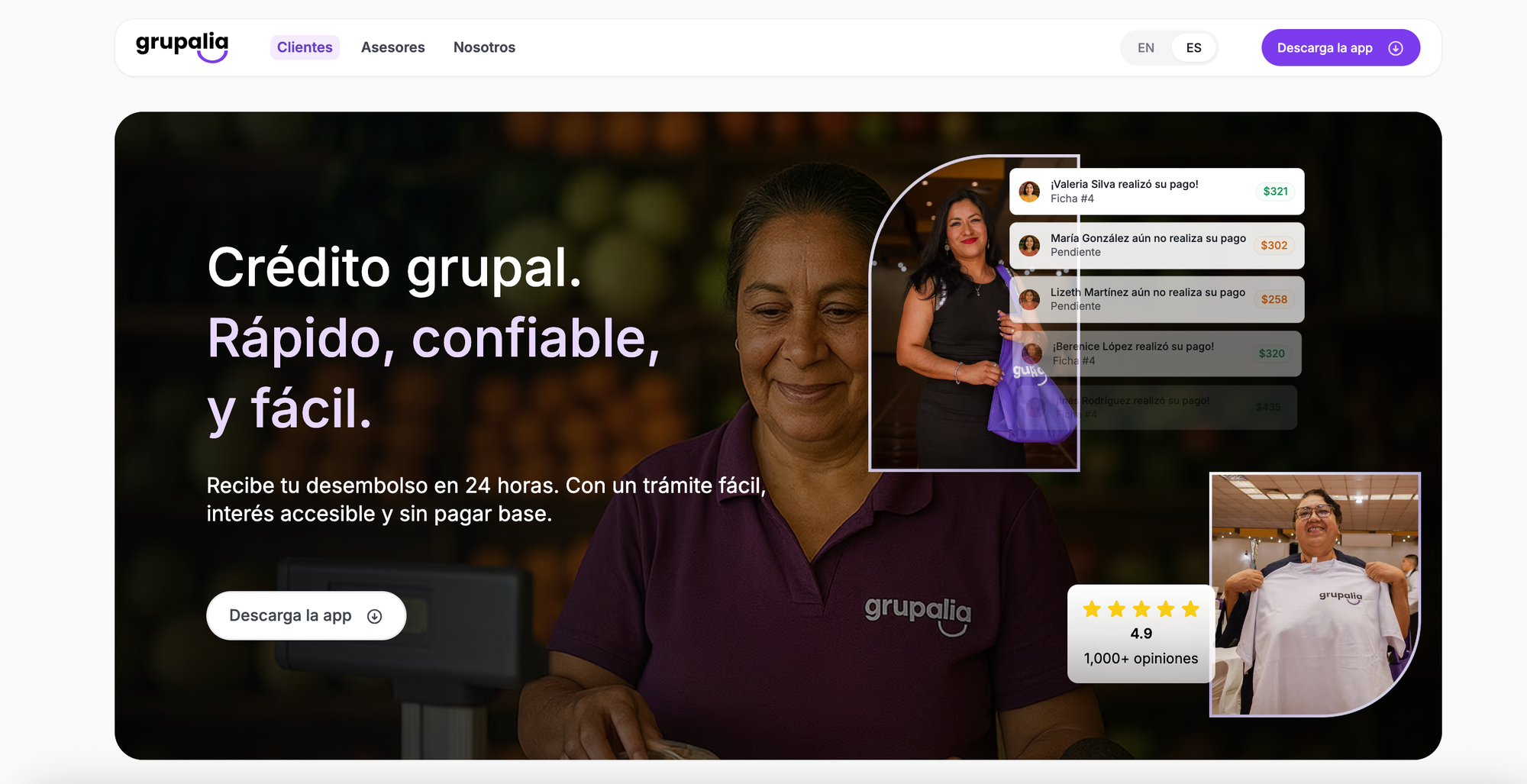

Grupalia is digitizing group lending in Mexico, using fintech to expand access to credit for microbusinesses and strengthen local economies.

Grupalia is reshaping access to finance for microbusinesses in Mexico by bringing technology to a decades-old model of community-based lending. Founded by fintech entrepreneur Rogelio Rea, the company combines personal history, digital innovation, and social impact to modernize group credit and support thousands of small entrepreneurs across the country.

Discovering a neglected segment of the economy

Rogelio Rea grew up surrounded by small businesses that sustained entire families. His grandmother ran a neighborhood convenience store that supported eight children, while his mother sold products through catalogues, often extending informal credit to her customers.

“I come from a family of microbusinesses,” Rea has said when reflecting on his early years.

Before founding Grupalia, Rea built his career in fintech through a buy now, pay later (BNPL) model. While scaling that business, he identified an unexpected trend: many of his most loyal users were small entrepreneurs using consumer credit to finance their businesses.

That insight revealed a larger structural gap. In Mexico, millions of microbusinesses collectively generate more than US$ 300 billion in GDP, yet they remain largely underserved by the formal financial system.

Too small for traditional business banking, many rely on consumer products not designed for productive use. Rea recognized both an opportunity and a mission: to design financial services specifically for this silent engine of the Mexican economy.

Building a neobank for microbusinesses

With that vision, Rea co-founded Grupalia in 2023, laying the groundwork for what would become Mexico’s first neobank focused on microbusinesses. The goal was straightforward but ambitious: use technology to eliminate the barriers that prevent small entrepreneurs from accessing productive credit.

“Microbusinesses are the most fundamental part of the economy, yet they remain brutally underserved,” Rea has stated.

From the outset, Grupalia was designed as a fully digital platform offering group loans tailored to small businesses. Instead of requiring extensive credit histories or complex paperwork, the company created an agile process suited to neighborhood shops, family-run food stalls, and home-based workshops, businesses that rarely fit traditional risk models.

Reinventing a decades-old group lending model

Group credit has been a cornerstone of microfinance in Latin America for decades, but its operational model has barely evolved.

“This industry hasn’t changed in thirty years,” Rea has said of traditional microfinance.

Historically, borrowers were required to attend in-person meetings, complete paper applications, submit physical documentation, and wait days for approval. Grupalia transformed that experience by fully digitizing the process. Through its mobile app, users can form groups, upload information, and apply for loans without paperwork or physical branches.

As a result, loan approvals are up to seven times faster than those of traditional players, introducing efficiency and scalability to a model that once relied heavily on manual processes.

Nearly 9,000 businesses financed in under two years

Since launching operations, Grupalia has achieved early results that validate its approach. In less than two years, the platform has provided productive financing to nearly 9,000 microbusinesses, surpassing USD 7 million in cumulative loan volume. The company reports an average monthly portfolio growth of 31% since inception.

Beyond financial metrics, the real impact is reflected in daily business operations:

- Restocked inventories

- New tools

- Improved efficiency

- And family businesses gaining the ability to grow rather than merely survive.

According to the company, these loans have contributed to the creation of more than 11,000 additional jobs, demonstrating a strong multiplier effect within local communities.

Investor confidence and market validation

Grupalia’s early traction has attracted significant attention from investors. In October 2025, the company announced the close of a USD 4.8 million pre-seed round, combining equity and debt to accelerate growth. The round included backing from funds such as Platanus, Semilla Ventures, Innogen Capital, and CAPEM, alongside a credit line from Addem Capital.

The investor base also features founders from prominent fintech companies, including Fintual, R2 Capital, Xepelin, and Atrato. This support underscores confidence in Grupalia’s vision and highlights the size of the opportunity: Mexico’s group lending market is estimated to exceed USD 10 billion annually.

Navigating the challenges of financial transformation

Digitizing a traditionally paper-based industry came with significant challenges. From the beginning, Grupalia faced three core questions: whether group credit could truly be digitized, how to manage risk without traditional guarantees, and how to scale the model nationwide.

“When we started, everyone told us it couldn’t be done,” Rea recalls.

To address these challenges, the company developed alternative verification systems, leveraging online analysis and non-traditional data, while also investing in digital financial education for users—many of whom had never used a banking app before. Careful underwriting and close group-level support have been critical to maintaining manageable default rates.

Leadership shaped by past adversity

Behind Grupalia’s growth is a founder shaped by earlier setbacks. Before launching the company, Rea founded a BNPL fintech at age 22 that scaled rapidly to nearly 100 employees. However, the combination of the pandemic and the 2022 tech downturn halted its momentum, forcing him to step aside as CEO and confront severe burnout.

“It pushed me to step back at the peak of the company and take personal time,” he has said.

That experience reshaped his leadership philosophy. Today, Rea emphasizes balance, resilience, and long-term sustainability—both for himself and his team. These lessons are reflected in Grupalia’s culture, where growth is pursued alongside personal well-being.

Scaling across Mexico and beyond credit

With its foundations in place, Grupalia is preparing to expand nationwide. The fintech currently operates in 10 Mexican states and aims to reach full national coverage in the near term. Its digital model allows the company to serve entrepreneurs across regions with equal efficiency.

Looking ahead, Grupalia plans to evolve into a primary financial partner for microbusinesses, gradually integrating additional services such as savings accounts, payment tools, and management solutions designed specifically for small entrepreneurs.

“Our technology allows us to serve millions of microbusinesses profitably—something that wasn’t possible just three years ago,” Rea has said.

As Grupalia continues to scale, its story reflects how technology, personal experience, and disciplined execution can transform traditional financial models while keeping human impact at the center.