Jeeves Secures US$100M from CIM to Scale Corporate Spend Management in Mexico

Jeeves announces a US$100 million financing facility from Community Investment Management to support corporate expense management, credit solutions, and business growth in Mexico.

Jeeves, a global financial infrastructure platform for businesses, continues to strengthen its presence in Latin America as Mexico becomes its fastest-growing market, supported by new strategic financing aimed at expanding access to credit and advanced expense management tools.

Jeeves Raises US$100 Million to Support Mexican Businesses

Jeeves announced a new US$100 million financing facility provided by Community Investment Management (CIM), an institutional impact investment manager focused on scaling responsible credit innovation for underserved segments.

The capital will be used to support Mexican companies that rely on Jeeves’ unified global platform for corporate expense management, corporate cards, bill payments, and treasury services.

This transaction deepens a long-standing relationship between Jeeves and CIM and increases the company’s total credit line from US$75 million to US$175 million, more than doubling the original amount.

Mexico Emerges as Jeeves’ Largest Global Market

The financing comes at a pivotal moment for Jeeves, as Mexico has become its largest market worldwide. Over the past 12 months, revenues in the country have grown by more than 250%, while net revenue retention has consistently exceeded 130%.

According to the company, this growth is driven by strong adoption among business customers, who increasingly use multiple Jeeves products as the platform expands nationwide.

“The rapid growth we’re seeing in Mexico reflects a clear shift among businesses toward a single, intelligent, and easy-to-use platform that provides visibility, control, and automation across all corporate spending,” said Dileep Thazhmon, Founder and CEO of Jeeves.

He added that the Mexico-focused financing enables Jeeves to support larger organizations and reinforces its strategy of building country-specific credit programs across the region.

A Unified Platform for Fast-Growing Enterprises

Jeeves currently serves thousands of companies across industries such as technology, mobility, logistics, and e-commerce. Its customer base in Mexico includes major brands like:

- SmartFit

- BMW

- Lululemon

- H&M

- MacroPay

- Kueski

- and Nubank, alongside businesses of all sizes.

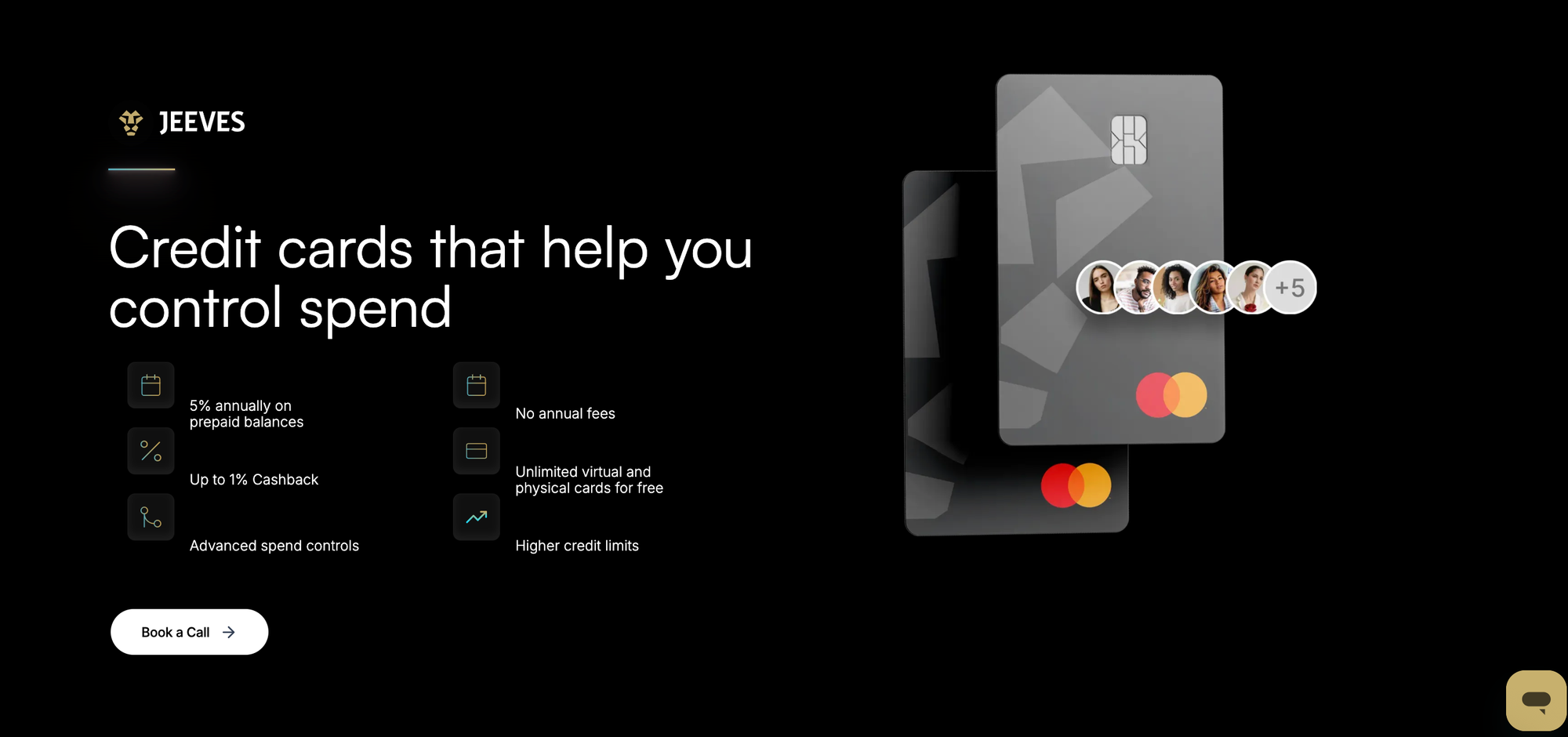

Most customers use multiple products, including cards, software, payments, and credit solutions, positioning Jeeves as a leading platform for corporate spend management among Mexico’s fastest-growing companies.

Mexico as a Hub for Financial Innovation

Mexico has also become a key innovation hub for Jeeves, leading the rollout of advanced capabilities tailored to the country’s regulatory environment. These include AI-powered automated invoicing compatible with SAT requirements, simplifying the creation and reconciliation of CFDI invoices.

The platform also offers new payment and ERP integrations, travel and expense APIs, and cross-border operations solutions. Through a third-party provider, Jeeves enables access to U.S. dollar-backed stablecoin wallets, designed to streamline cross-country reconciliation and settlement.

Together, these developments reinforce Jeeves’ position as a leading unified platform for corporate spend automation in Latin America.

Strengthening Risk and Compliance Capabilities

The financing coincides with the appointment of Pablo Cortina as Chief Risk Officer (CRO) of Jeeves. Cortina brings over 20 years of experience in credit risk, fraud, data science, and artificial intelligence models in digital banking.

Before joining Jeeves, he spent more than 12 years at Capital One in the United States, and will now focus on strengthening the company’s risk and compliance infrastructure as its financial automation and credit solutions scale.

Long-Term Support from Community Investment Management

From CIM’s perspective, the partnership reflects a shared commitment to expanding access to modern financial infrastructure.

“Jeeves’ traction with businesses in Mexico is exceptional, and this financing is designed to help meet growing demand for credit solutions and advanced corporate expense management tools,” said Elena Amato, Managing Director at Community Investment Management.

With operations in more than 20 markets, Jeeves continues to position itself as a key financial partner for high-growth companies and corporates with regional operations. The expanded credit facility strengthens its ability to support businesses that require agile expense management and flexible access to credit to compete in global value chains.