Lux Capital Invests US$5M in Magie to Power Enterprise Payments on WhatsApp

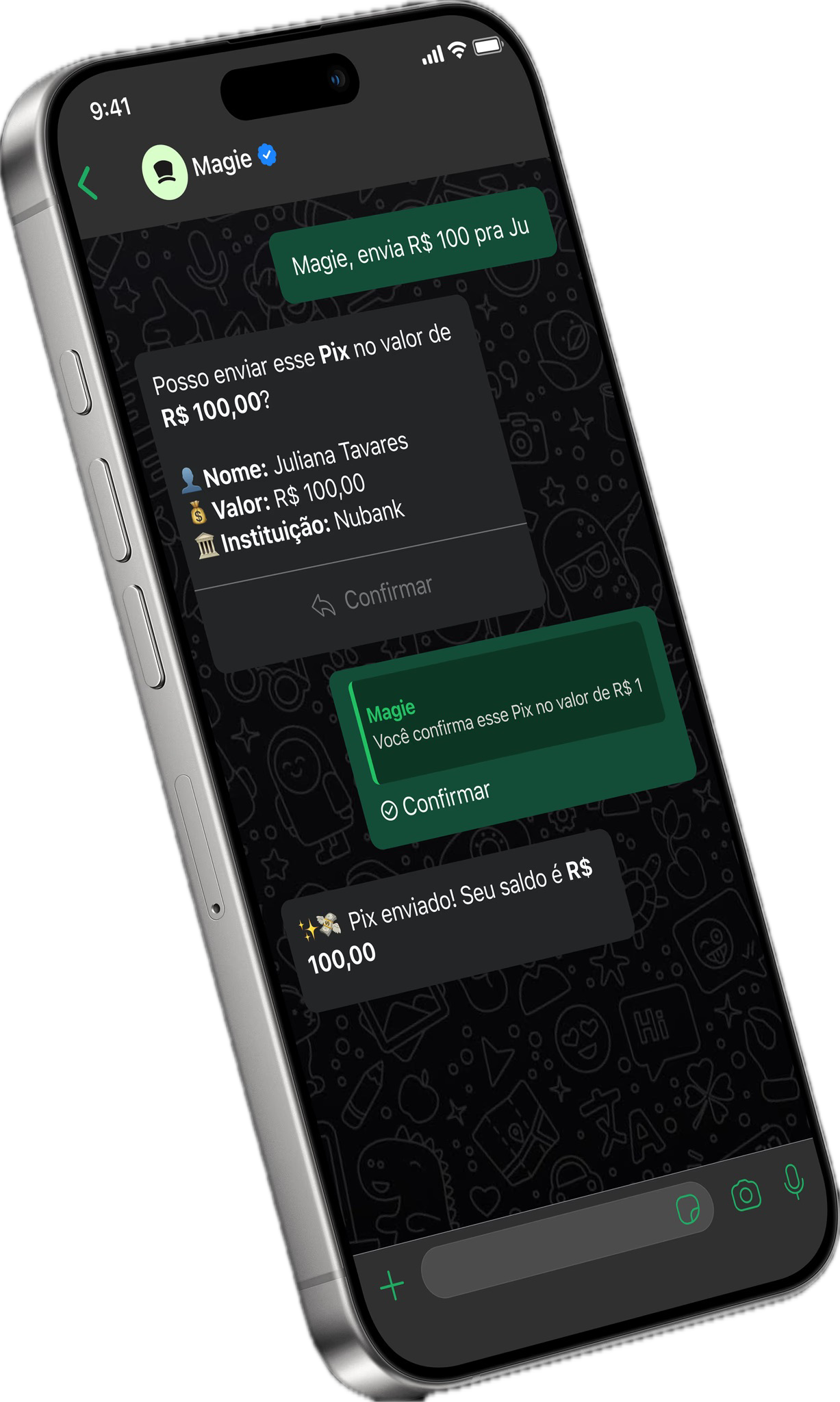

Lux Capital invests US$5M in Brazilian fintech Magie, which is pivoting from consumer payments to B2B conversational finance infrastructure on WhatsApp.

Lux Capital has led a new US$5 million funding round in Magie, a Brazilian fintech that pioneered Pix and other banking transactions directly through WhatsApp. Rather than focusing on user growth, already validated, the investment targets a much bigger challenge: how to build a sustainable business inside Meta’s messaging ecosystem.

Magie shifts from consumer growth to enterprise infrastructure

Magie gained early traction by proving that conversational banking works for consumers. Since launch, the startup has surpassed 400,000 users and processed more than R$2 billion in transactions. Its success helped open the door for large banks and fintechs to offer Pix via WhatsApp, but it also exposed the limitations of a free B2C model.

The company is now pivoting toward B2B, positioning itself as an invisible infrastructure layer for businesses that want to offer payments and financial services inside WhatsApp, without building everything from scratch. Its solutions will operate in a white-label format, under the client’s brand.

Why Lux Capital doubled down on Magie

This marks the second round led by Lux Capital, which counts Magie as its only Latin American company in a portfolio that includes Databricks, Hugging Face, and Anduril. Last week, Lux announced a US$1.5 billion deep tech fund focused on “turning science fiction into scientific fact,” a thesis that aligns closely with Magie’s use of generative AI in financial transactions.

Founded in 2024, Magie was among the first startups globally to apply generative AI to conversational finance, a segment that remains largely unexplored.

Building “financial agents” for enterprises

Magie’s new strategy is to sell conversational financial agents to companies in sectors such as retail, healthcare, and telecommunications, while also expanding into other Latin American markets where WhatsApp dominates.

The company plans to move cautiously, onboarding one to two clients per quarter through the end of 2026, following a soft-launch approach.

“It makes sense to strengthen our balance sheet to capture the B2B opportunity, which requires team, product, and platform investment,” said founder and CEO Luiz Ramalho. In the previous US$4 million round, Canary joined Lux as an investor.

B2C remains a testing ground and a funnel

Despite the B2B focus, Magie will keep its free consumer product active. It serves as a testing environment and also functions as a gateway to enterprise adoption.

“Many executives already use WhatsApp for personal payments,” Ramalho noted.

He compares the model to companies like OpenAI and Anthropic: free consumer chatbots paired with enterprise monetization through infrastructure.

“They have strong B2C businesses, but most of the revenue comes from B2B, and the end user often doesn’t even know who’s behind it,” he said. “These are complementary businesses.”

Navigating Meta’s evolving WhatsApp policies

Magie’s expansion comes as Meta reshapes WhatsApp’s business ecosystem. In October, the company banned third-party applications from using chatbots built by external AI providers like OpenAI’s ChatGPT or Google’s Gemini, requiring instead the use of Meta AI.

This move directly affected conversational startups such as Zapia and Luzia, which filed complaints with Brazil’s antitrust authority (Cade), triggering an investigation. Ramalho says Magie remains unaffected, as the fintech does not rely on chatbots that compete with Meta AI.