Monet Closes US$ 24M Series A backed by Ventures Comfama, Transforming Access to Credit in Colombia

Monet raises US$ 24 million in a Series A round to expand financial inclusion in Colombia through small-ticket loans and advanced risk assessment technology.

Monet has announced the closing of a US$ 24 million Series A investment round, structured as a mix of equity and debt, positioning the Colombian platform as one of the country’s most promising fintech companies focused on financial inclusion through small-ticket loans.

A strategic funding round in a challenging investment climate

The new capital will enable Monet to strengthen its technology, expand nationwide coverage, and enhance its risk assessment tools to reach more users. The round was backed by a U.S.-based credit facility and additional investors, including Ventures Comfama, an organization focused on supporting high social-impact ventures across Colombian territories.

In a complex investment environment marked by cautious funds and reduced foreign capital inflows, Monet successfully closed this round, reflecting strong market confidence in its business model, growth potential, and proven social impact. The company now operates across 100% of Colombia’s departments.

Providing alternatives to informal lending

This milestone represents a major step in Monet’s strategy to offer safe alternatives to the widespread “gota a gota” lending practice in many regions.

“This round confirms that financial inclusion is both an urgent need and a powerful opportunity to generate real well-being. Our purpose is to continue building tools that allow more people to access fair, fast, and reliable financial solutions,” said Leonardo Devincenzi, CEO of Monet.

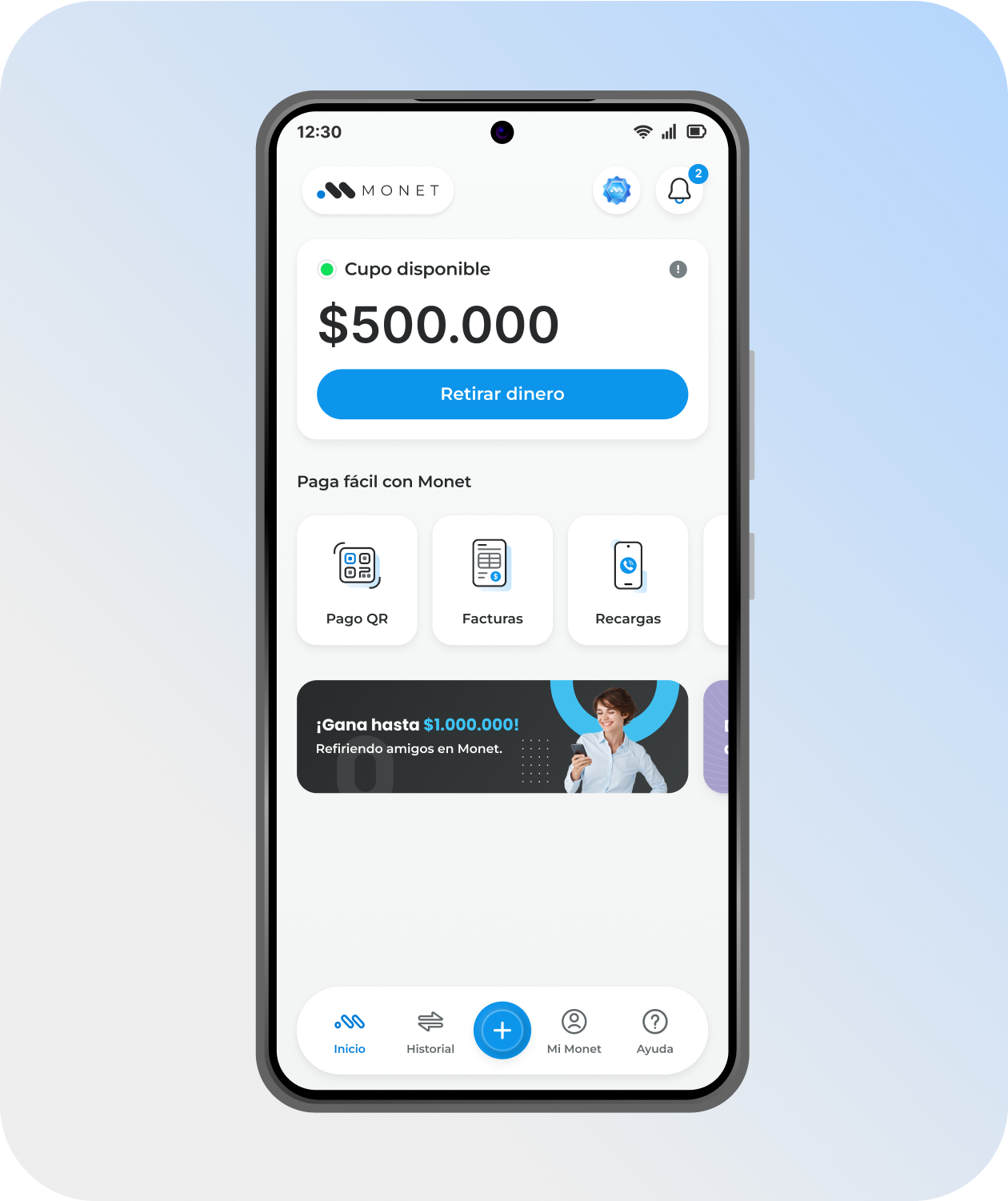

The app, which provides access to loans ranging from COP 50,000 to COP 500,000, has become a financial lifeline for informal workers, entrepreneurs, and citizens who do not qualify within the traditional banking system.

Scaling operations and regional expansion

With rapidly growing operations, Monet projects the placement of 3.5 million loans in 2026, driven by strong demand and its ability to assess non-traditional financial profiles.

The company also announced plans to expand into Mexico in the fourth quarter of the same year, paving the way for a scalable model across Latin America.

Financial inclusion for migrant communities

A key priority in this new phase is the inclusion of Venezuelan migrants through a credit offering that does not require prior credit history or co-signers, targeting nearly two million individuals regularized under Colombia’s Temporary Protection Permit (PPT).

Colombia is home to more than 2.8 million Venezuelan migrants, of whom 1.9 million already hold authorized PPT status, according to Migración Colombia.

Building a more accessible financial ecosystem

With this investment, Monet advances its commitment to transforming access to credit in Colombia and the region, consolidating its role as a key player in building a more accessible, transparent, and inclusive financial ecosystem.

Its participation contributes to strengthening a formal alternative for those who have historically relied on informal loans under abusive conditions.