Monnet Payments Strengthens Its Presence in Chile After Acquiring ETpay

Monnet Payments acquires Chile’s ETpay to strengthen its LatAm presence, expand services, and reach USD 5B in transactions by 2025.

Monnet Payments, the Peruvian fintech specializing in collection and disbursement solutions, has announced the acquisition of Chilean payment platform ETpay, marking a major step in its regional expansion strategy. With this move, the company expects to reach 70 million transactions in Chile and process USD 5 billion by the end of 2025.

Strengthening regional operations through acquisition

Founded in 2020 by Franco Zurita and Eduardo Luna, Monnet Payments has grown steadily across Latin America. The acquisition of ETpay, whose amount remains undisclosed, brings strategic synergies for both companies.

“We knew ETpay very well; they were our best-performing provider and a key partner. Through our collaboration, we found great complementarity and a strong personal and professional alignment,” said Eduardo Luna, CEO of Monnet Payments, in an interview with Forbes.

For ETpay, this partnership represents an opportunity to internationalize its operations, which currently extend to Peru, Chile, Argentina, Ecuador, Colombia, and Brazil. The acquisition adds 90 to 100 new Chilean clients and around 20 global clients from Mexico to Monnet’s portfolio.

Expanding services and technological capabilities

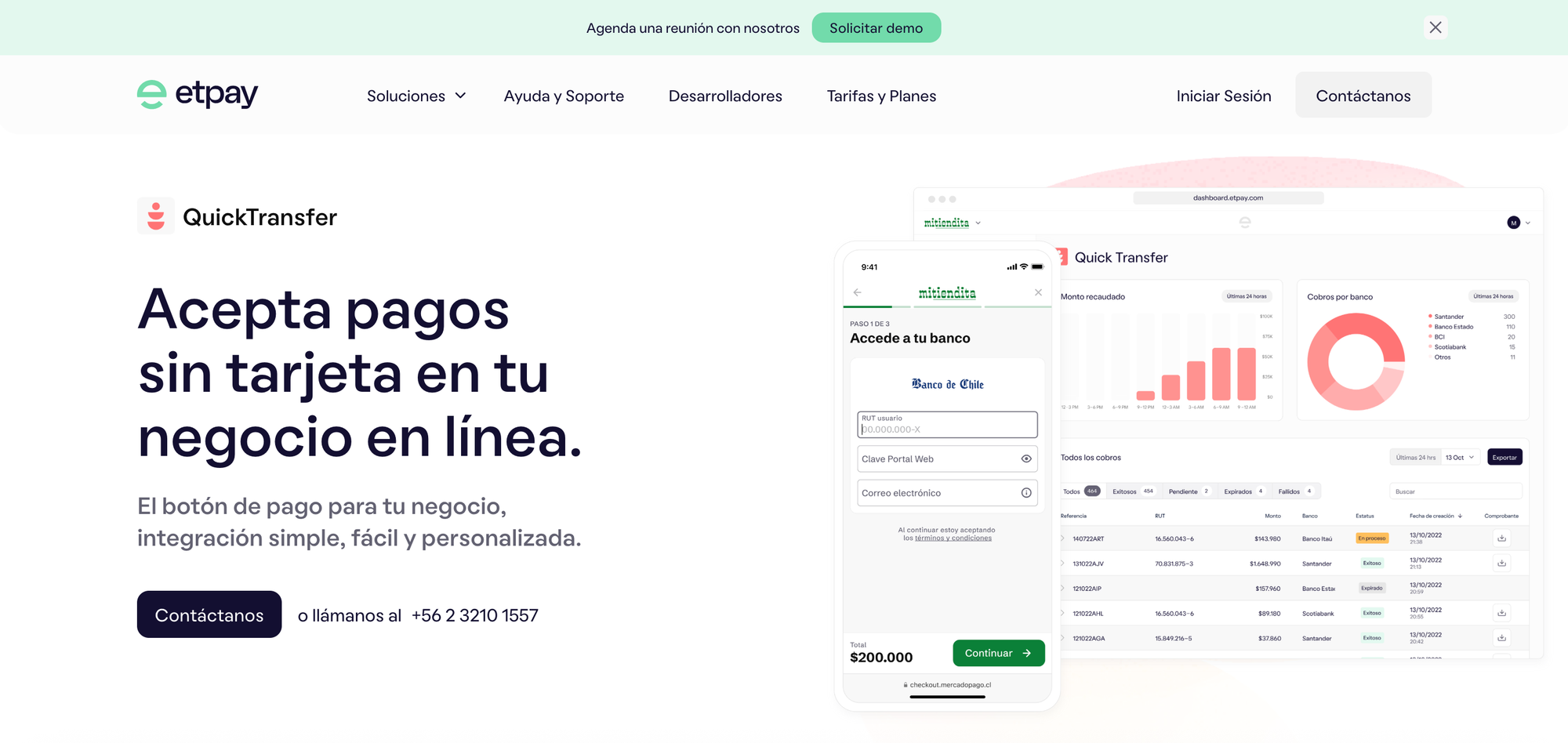

ETpay, founded in 2018, offers a bank-to-bank transfer system, a feature previously missing from Monnet’s service suite.

“They have a robust system to process small-value transactions,” noted Franco Zurita, emphasizing how the deal strengthens their reach in Chile’s banking ecosystem.

Following the acquisition, Monnet Payments will increase its workforce from 250 to 300 employees, with 45% dedicated to product and technology.

Strategic growth and regional expansion plans

As part of the integration process, Franco Zurita will assume the role of Chief Strategy & Growth Officer (CSO), leading the development of new products and overseeing market expansion.

“We plan to open operations in three additional countries within the next six months: the Dominican Republic and, pending confirmation, Bolivia, Paraguay, or Panama,” Zurita revealed.

In parallel, the company will appoint a Chief Operating Officer (COO) based in Uruguay, where it plans to establish a new tech and commercial hub. “We initially built our software in Uruguay, and we already have teams in Peru and Chile. This third hub will allow us to serve global clients more efficiently,” explained Luna.

A sustainable and profitable growth model

Monnet Payments financed the ETpay acquisition through loans from Banco de Crédito del Perú and Banco Santander, to be repaid over five years. The fintech has been bootstrapped since inception, achieving profitability within six months of its 2021 operations and maintaining positive EBITDA each year.

In 2024, the company reported revenues of USD 30 million and expects to close 2025 with USD 50 million, including ETpay’s contribution. Zurita attributes this growth to “a broader client base and cross-selling opportunities across markets.”

Looking ahead, Monnet will invest USD 4–5 million in technology, talent, and expansion, financed through reinvested profits.

“Monnet Payments remains a profitable company to this day,” confirmed Luna.

Entering the Brazilian market through partnerships

In 2024, Monnet Payments entered Brazil through a strategic alliance with Pagseguro (PagBank) to manage local collections and disbursements.

“It’s a two-way agreement, Pagseguro supports our local transactions, and we offer the same across Latin America,” explained Zurita.

He noted that while Brazil is a competitive and mature market with shrinking margins, it remains a valuable addition to the company’s broader regional strategy.