SaaSholic Reveals the New VC Filter in LATAM: No AI, No Check

Artificial intelligence is no longer a future promise — it's the strategic present of the SaaS ecosystem in Latin America. This is the core message of the latest report by SaaSholic, a key player in analyzing B2B software companies in the region. Based on fresh data and direct insights from founders, the report offers a clear diagnosis: for startups looking to scale, raise capital, and stay competitive, AI is no longer optional — it’s the starting line.

This study is part of an ongoing effort led by SaaSholic, a prominent early-stage venture capital fund, supported by strategic partners including AWS, Nvidia, and Cuantico VC.

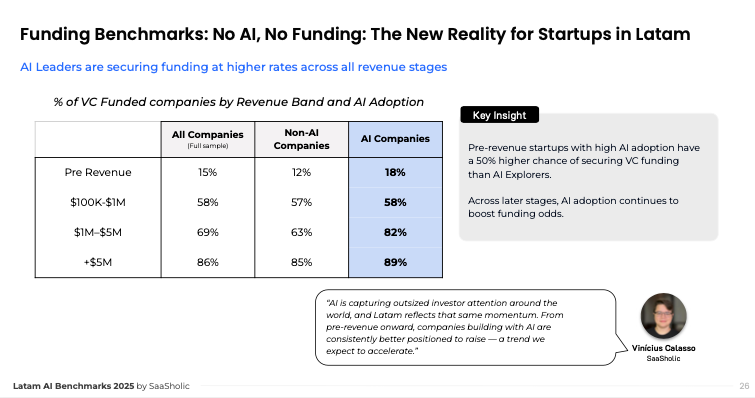

No AI, No Capital: The New Rule for Venture Investors

The report makes one thing very clear: venture capital in the region is flowing almost exclusively to startups with an AI-driven approach or integration. Why? Because AI is no longer considered a “nice to have” — it’s a must-have filter in investment selection.

However, using AI doesn’t guarantee sky-high valuations. While AI-focused startups are more likely to raise funding, the data shows they aren’t commanding Silicon Valley-style multiples. The pressure is double: real performance is expected, but without overpricing. In a capital-constrained environment, AI is a qualifying criterion — not just a hype driver.

LATAM Doesn’t Need to Build the Next OpenAI

Globally, AI leadership is often associated with companies developing foundational models at massive scale. But Latin America is carving a different path. Instead of racing to build the next GPT, local startups are applying AI to solve real, regional challenges: fragmented logistics, access to financial services, preventive healthcare, or SME automation.

This approach comes with clear advantages: less capital required, faster development cycles, and immediate impact. According to the study, LATAM valuations are more grounded — focused less on 10-year projections and more on early results.

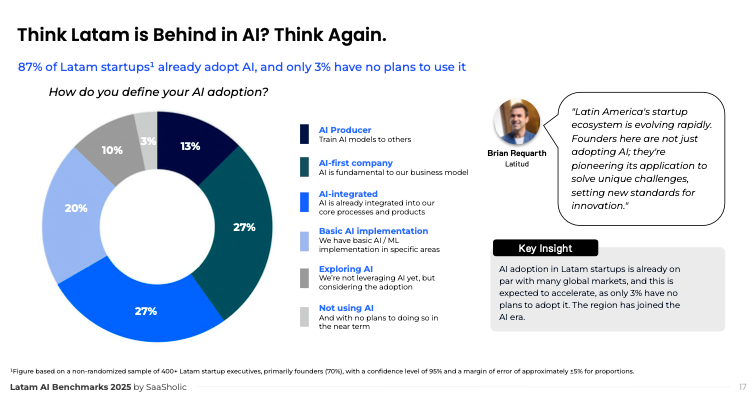

AI Is Not a Trend — 87% of Startups Already Use It

One of the most striking findings of the report is how deep AI adoption already runs: 87% of surveyed startups are already integrating AI into their operations or products. Among startups founded in the last three years, over 60% were born with an AI-first approach.

This shift is transforming not just product development, but also team structures, business models, and performance metrics. Still, direct monetization of AI features remains in early stages. For most companies, AI is still a powerful enabler — driving efficiency, retention, and personalization — rather than a standalone revenue line.

AI Is Delivering Results — This Is No Longer Experimental

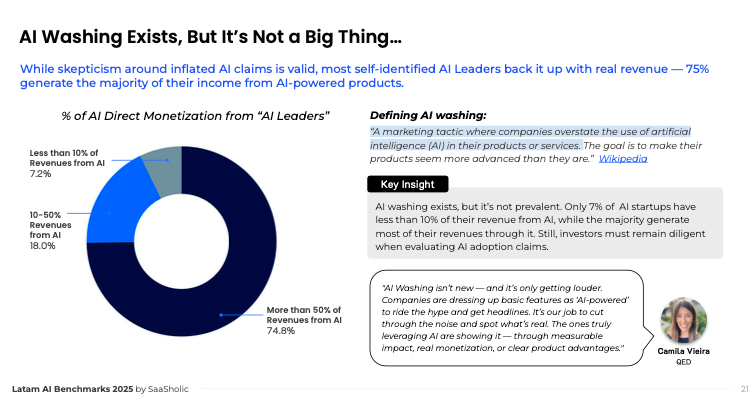

The report confirms what many suspected: AI is already generating measurable business value. More than 70% of startups that have adopted AI report tangible improvements in key performance metrics.

These include lower operating costs, better conversion rates, faster sales cycles, and automation of critical tasks. Most importantly, companies are actively tracking ROI from their AI investments — signaling a more mature, value-driven mindset, not just technical innovation.

The Native AI Wave Has Arrived — and It’s Threatening the Incumbents

SaaSholic’s study also delivers a clear warning to traditional companies: startups built around AI from day one are growing faster and claiming market share. 75% of these AI-native companies report accelerated growth in the past year — a stark contrast to businesses that haven’t adopted AI structurally.

A new generation of challengers is emerging — ones that don’t just automate processes but reimagine entire industries. Meanwhile, many incumbents are still tied to legacy structures and outdated models, leaving them increasingly vulnerable to disruption.

LATAM Isn’t Copying Silicon Valley — It’s Carving Its Own Path

SaaSholic’s report paints a picture of a SaaS ecosystem that embraces AI not as a gimmick but as a core driver of value and differentiation. Founders across the region understand that the future doesn’t belong to those with the most data — but to those who know how to use it effectively.

In this new game, Latin America isn’t lagging — it’s solving local problems with global solutions. And that may just be its greatest strength.