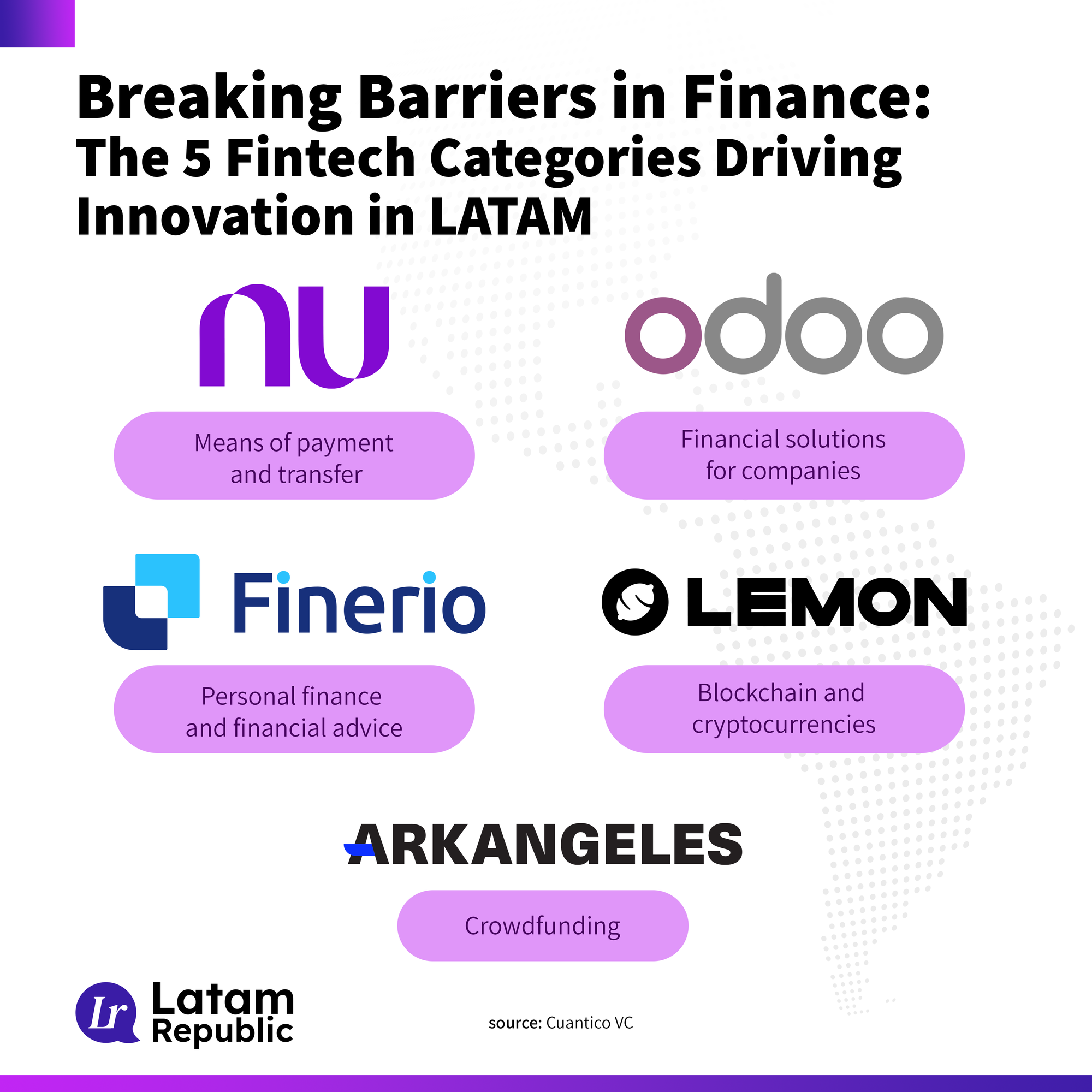

Breaking Barriers in Finance: The 5 Fintech Categories Driving Innovation in LATAM

The Fintech industry is going through moments of expansion in several countries in the region, and numerous companies have emerged to engage in this business.

The Fintech industry is currently going through moments of boom and expansion in several countries of the region. Numerous companies have emerged to engage in this business, and traditional banking has also jumped on this trend that is gaining more users and customers every day.

Some of the main characteristics used by these types of companies is technology to facilitate financial tools, which translates into better interfaces, more advanced authenticity systems and fewer requirements to access financial products.

This feature not only allows these companies to contribute to the development of the financial sector, but also helps promote inclusive financing in social areas that traditional banking has not been able to reach.

To understand a little more about the subject, let's see some essential categories of the fintech industry and their success stories in Latin America.

Means of payment and transfer

Money transfer and electronic payments are some of the financial technology tools that many of the companies that make up the fintech industry have focused on. These applications are characterized by offering platforms, in many cases focused on the mobile phone, which are integrated with traditional banking and make it possible to dispense with the physical card

A clear example of this is the Brazilian financial company Nubank, which was created in 2013 to redefine people's relationship with money through simple services, mobile banking and credit cards.

In addition, it has become, in recent years, the largest online bank in the Western world. His secret has been to focus on providing a customer experience with financial services that are easy to understand, with intuitive applications and exceptional customer service.

Financial solutions for companies

There are companies that specialize in the creation of accounting and financial management software and applications, offering technological solutions to small, medium and large-scale companies. One of them is the fintech Oddo, whose vision is to optimize operations for small and medium-sized companies, offering accessible and affordable solutions.

Founded in 2005, this company thrives on a unique, fully open ecosystem that combines the resources of its community and partners to deliver a full range of easy-to-use, integrated, and scalable business applications.

This company's offering includes apps that cover all business needs: accounting, inventory, manufacturing, project management, human resources, marketing, website creation, and more.

Personal finance and financial advice

These companies focus more on educational nature and financial advice. Despite the fact that digital banking is in the "boom" of the revolution, there are still many people who do not have some experience and basic knowledge to manage their finances, personal or business.

Therefore, the business model of these companies is characterized by offering services or applications that help manage your money, software for buyers and distributors of financial products, financial education, advice, as well as financial management.

Finerio is one of them, since it is considered one of the first automated personal finance applications in Mexico. This app allows you to create budgets in various categories. It gives you the possibility to establish a spending limit and, through graphs, it shows you when you have exceeded it.

Perhaps the most important feature is that it is automated and focused on the habits of Mexicans. Immediately classify your expenses and income when you enter them manually, which saves you time to record your movements. If you decide so, you can link your credit or debit cards so that all your expenses and income are classified automatically.

Blockchain and cryptocurrencies

In recent years, this type of business has increased in popularity, due to the emergence of cryptocurrencies, bitcoin, among others. Entrepreneurs have focused on offering financial solutions using blockchain technology and digital tokens.

An example of this is the fintech Lemon, which seeks financial inclusion in Latin America by facilitating the use and access to cryptocurrencies. In 2021, it raised US$16.3 million in financing in its Series A. The highest for an Argentine company in the sector.

Its main product is the Lemon Cash virtual wallet, with which you can buy and sell cryptocurrencies, send and receive money (pesos or cryptocurrencies), and receive weekly earnings in digital currency.

It is recognized as the only provider of dual payment services in the Latin American market, since it also allows operating with Argentine pesos.

Crowdfunding

These companies focus on using software tools that facilitate investment for startups that do not have huge capital.

In addition, these companies give small and medium-sized companies the opportunity to obtain capital for the development of their business. They also give small investors the opportunity to be part of the growth of an emerging venture.