Celcoin Accelerates Its Growth Strategy With the Acquisition of Vulkan Labs

Celcoin announced the acquisition of Vulkan Labs, an AI-driven risk decision platform, marking its sixth purchase in three years. The deal strengthens its credit infrastructure, expands its no-code capabilities, and supports a rapidly growing ecosystem serving over 750 fintechs and digital banks.

Celcoin has taken another step in expanding its financial infrastructure capabilities, announcing the acquisition of Vulkan Labs, a Brazilian startup specializing in AI-powered risk decision engines.

Although the financial terms were not disclosed, the deal reinforces the company’s commitment to strengthening its credit solutions and scaling its technology ecosystem.

Strengthening a Rapid Acquisition Strategy

This marks Celcoin’s sixth acquisition in three years and the third focused specifically on credit. The infratech previously acquired Flow Finance, a credit infrastructure provider, and CobranSaaS, a company dedicated to credit portfolio management and collections. According to the company, this new M&A move is expected to more than double the size of Celcoin’s credit division before the end of the year.

Today, Celcoin offers a comprehensive suite of tools covering the entire credit cycle, ranging from onboarding, antifraud systems, simulations, proposals, and digital signatures to the issuance of credit instruments such as CCBs and commercial notes, asset management, and structured collection flows. Over 250 companies currently use Celcoin’s credit vertical, including Cielo, Neon, Casas Bahia, Americanas, Pernambucanas, Super Sim, and Jeitto.

A Move Aligned With Industry Transformation

“The acquisition of Vulkan allows us to anticipate trends in a transforming sector that increasingly demands efficiency, personalization, and scale,” said Marcelo França, CEO and co-founder of Celcoin.

He emphasized that the combination of a validated technology stack and a highly specialized team will significantly enhance Celcoin’s capacity to deliver robust solutions.

Integrating Vulkan’s No-Code AI Platform

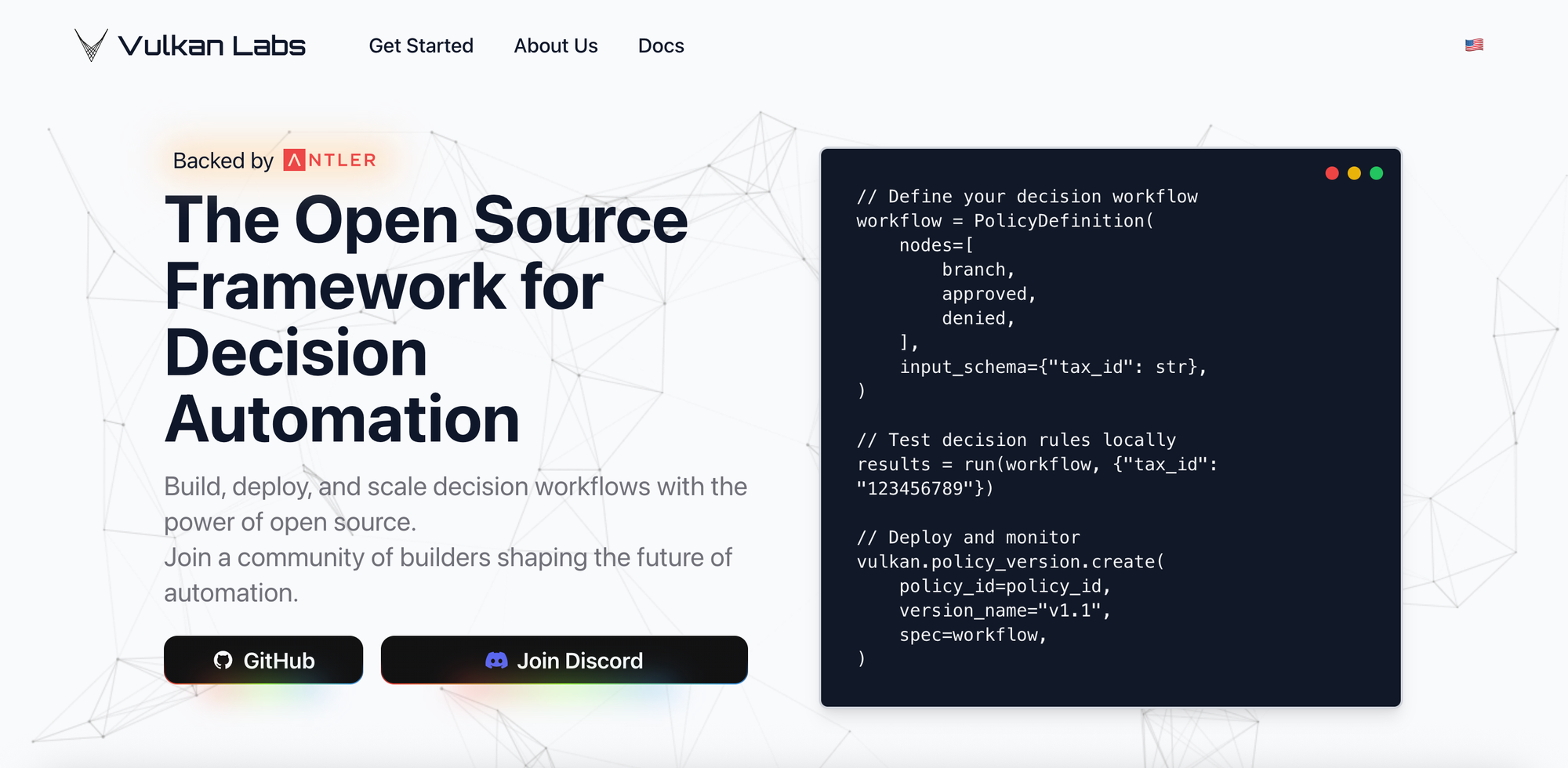

With this transaction, Celcoin incorporates Vulkan’s no-code platform, which orchestrates multiple data sources and automates real-time decision flows. Founders Bruno Sztutman (ex-C6) and Antonio Pedro Vieira (ex-Nubank and C6) will continue leading the operation within Celcoin.

Vulkan’s solution enables clients to configure personalized workflows, monitor portfolios, and access analytics, without writing a single line of code. The company has also built a comprehensive data marketplace integrated with dozens of external sources and bureaus, including Open Finance, SCR, and Serasa. As an AI-native tool, it can be applied across a wide range of use cases such as risk analysis, onboarding, fraud prevention, compliance, and operational decisioning.

“We founded Vulkan to bring more flexibility and intelligence to automated decision-making,” explained Antonio.

Fellow co-founder Bruno added that the platform empowers clients across Brazil to build faster, safer, and more customized decision journeys.

A Strategy Rooted in Inorganic Expansion

Since 2022, Celcoin has closed six acquisitions:

- Galax Pay (payments and sub-acquiring)

- Flow Finance (credit infrastructure)

- Finansytech (Open Finance)

- Reg+ (banking regulation)

- CobranSaaS (credit portfolio and collection management)

- and now Vulkan Labs.

To date, Celcoin has raised R$ 820 million in investments. Its latest round came in early 2024, when the company secured R$ 650 million in a growth-stage investment led by Summit Partners. About a year ago, Celcoin also appointed Sergio Meirelles, former iFood and Citi executive, as Executive Director of Strategy and M&A.

“With the integration of Vulkan, we also accelerate our innovation roadmap, expanding the use of the decision engine beyond credit,” he noted.

Founded in 2016, Celcoin now connects more than 750 digital banks, unicorns, and fintechs, collectively processing R$ 40 billion per month through its platform.