Pagaleve Secures USD$ 30M round from OIF Ventures and Sun Hung Kai & Co

Pagaleve raises $160M to expand its BNPL services in Brazil, leveraging AI-powered risk management, low default rates, and innovative Pix installment solutions for over 5 million users.

Pagaleve, the fintech enabling installment payments via Pix, has closed a R$160 million (USD$ 30M) funding round combining equity and contributions to the company’s FIDC. With this capital injection, the company reaches a valuation approaching R$1 billion (USD$ 1.8M), edging closer to unicorn status.

Henrique Weaver, CEO and co-founder of Pagaleve, commented:

“We started 2025 already in the black and expect to end the year with a very solid profitability position. This round gives us the energy to accelerate innovation, launch products that transform the consumer purchase experience, and strengthen our retail partners.”

Strong Growth and Expanding Partnerships

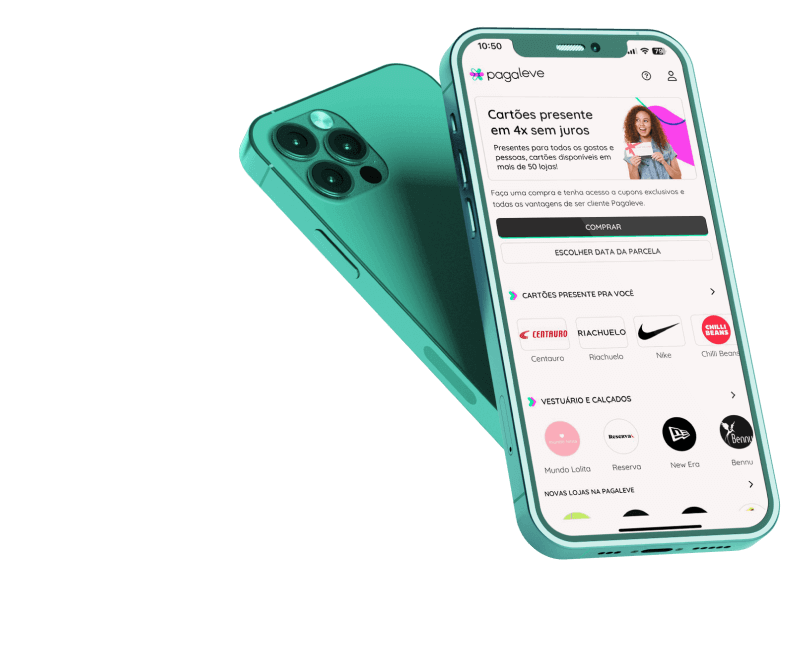

Founded in 2021 by Henrique Weaver (ex-McKinsey, Coca-Cola, Uber) and Michael Greer (ex-Zip, Australian BNPL unicorn), Pagaleve offers biweekly installment payments in four interest-free installments via Pix. The fintech also provides monthly installments (up to 12 with interest) and its “Parcela Tudo” service, which allows users to split payments at any Pix-accepting merchant.

The company currently partners with over 10,000 retailers, including:

- AliExpress

- Temu

- Drogaria Pague Menos

- Grupo Soma (Reserva and Farm)

- Grupo Aste (Diesel, Coach)

- and Vivara.

In the past 12 months, Pagaleve processed approximately 10 million transactions and now handles an annualized transaction volume (TPV) of R$3 billion, four times higher than last year. Revenue has grown sixfold in the same period, with a forecast of reaching R$500 million in annualized revenue by the second half of 2026.

Recurring Users Drive Growth

A key indicator of Pagaleve’s traction is customer recurrence: 62% of users make a second purchase after their first transaction. Recurring customers now account for 75% of revenue.

“This potential for loyalty is why we believe the Pagaleve brand is on track to become synonymous with installment payments for Brazilian consumers,” Weaver explained.

The BNPL model is gaining traction in Brazil, where 79% of consumers habitually split payments, yet 38% lack credit cards. Among cardholders, many face low credit limits, limiting their ability to pay in installments, creating fertile ground for Pix-based BNPL.

AI-Driven Risk Management with Low Default Rates

Pagaleve’s technology-heavy team has developed a proprietary, AI-native risk and transaction security system. Approval rates reach 70%, with a default rate of just 2%.

“We built a company that invests heavily in artificial intelligence from day one, and these figures explain our accelerated growth in just four years,” said Weaver.

The fintech’s risk engine achieves a KS coefficient of 45% for new users, far above market norms of 20–25%, reflecting its ability to accurately distinguish between high- and low-risk customers. By leveraging detailed data, including SKUs and device information, Pagaleve maintains low defaults, high approval rates, and increased sales for partner merchants.