Refurbi Raises US$4M to Expand Circular Tech Model into Mexico, led by Latin Leap

Refurbi raises a US$4M seed extension to expand its circular economy model into Mexico, strengthening refurbished device access and digital inclusion across Latin America.

Refurbi announced the closing of a US$4 million seed extension round combining equity and debt, as part of its strategy to strengthen its growth and deploy operations in Mexico, one of the most relevant technology markets in Latin America.

Funding round led by Latin Leap with regional and impact investors

The round was led by Latin Leap and included participation from impact and financial investors such as Impact Ventures PSM (the impact investment arm of Promotora Social México), Epic Angels, and David Buenfil, former CEO of Skandia Latam.

It also received backing from multilateral and banking institutions, including the Inter-American Development Bank (IDB) and Banco Itaú, reflecting growing investor interest in refurbished technology and circular economy models across the region.

Building trust in refurbished technology across Latin America

Founded in Colombia, Refurbi emerged with the goal of accelerating the transition toward more sustainable mobile devices in a market historically marked by informality and low consumer trust. To address this, the company combined industrial refurbishment processes with proprietary technology and a value proposition centered on user confidence.

Over time, Refurbi evolved into a comprehensive ecosystem that includes a refurbished device marketplace, trade-in programs, specialized software, as well as financing and insurance solutions. This integrated model enables retailers, manufacturers, operators, and insurers to manage device lifecycles more efficiently.

Market leadership and early profitability in Colombia

After validating its model locally, Refurbi became the market leader and fastest-growing company in refurbished technology in Colombia, reaching profitability in 2024, a milestone uncommon for startups at this stage. To date, the company has served more than 80,000 users and estimates it has participated in approximately 0.5% of the country’s total mobile phone market.

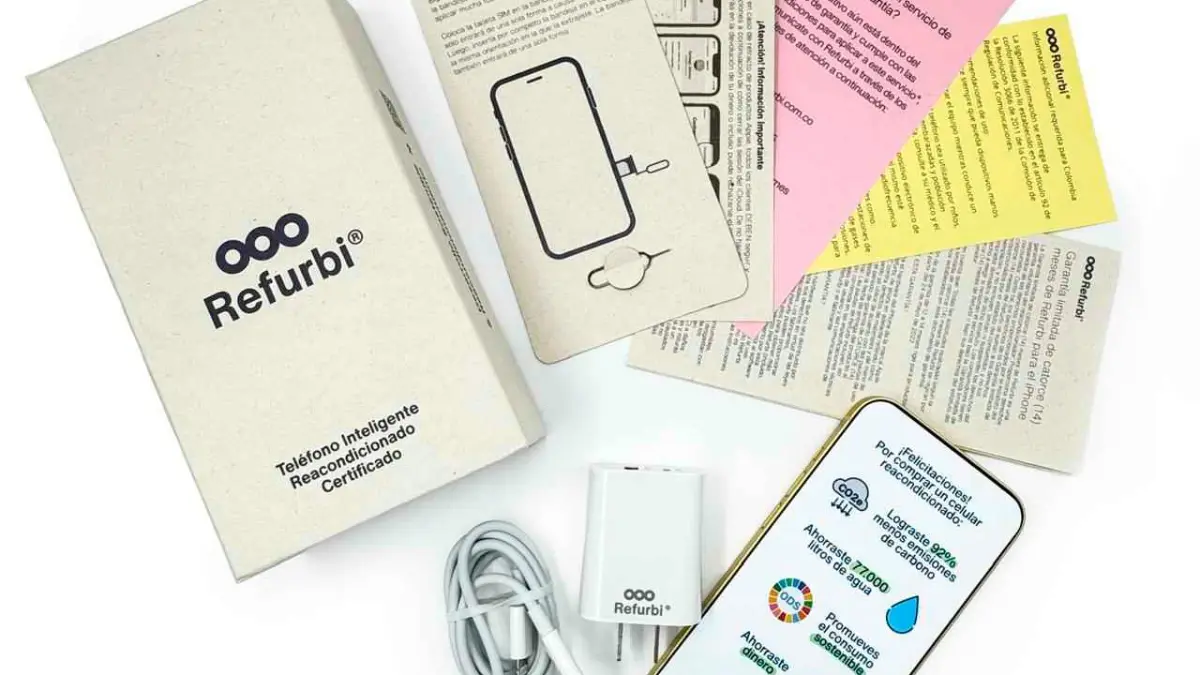

This scale allowed Refurbi to industrialize operations and strengthen a trust-based offering, including a 14-month warranty, packaging comparable to a new device with lower environmental impact, and a 30-day return policy, laying a solid foundation for structured regional expansion.

Expanding into Mexico and scaling toward US$100M in revenue

In this context of operational consolidation and business validation, Refurbi raised this seed extension as a strategic step to accelerate its entry into the Mexican market. The capital will support commercial scaling, advance the company toward its US$100 million revenue target by 2030, and deploy its proprietary trade-in technology in Mexico, working closely with retailers, manufacturers, and telecom operators.

“This round allows us to consolidate what already works and take our model to a new scale in Mexico,” said Sebastián Jiménez, CEO and founder of Refurbi. “Our focus is on deepening operational efficiency, expanding our internally developed technology, and collaborating with major ecosystem players to facilitate more sustainable access to technology.” He added: “We believe that well-executed refurbishment can become key infrastructure for digital inclusion in the region.”

Refurbished devices gain traction as a structural solution in the region

The round takes place as the refurbished device market and circular economy models consolidate as structural alternatives in Latin America, following successful examples such as Back Market, Refurbed, and Atrenew in more mature markets.

In a region characterized by limited access to technology, sustained increases in the price of new devices, and growing environmental awareness, solutions that extend the lifespan of electronic equipment have moved beyond niche adoption to become a relevant response to challenges around digital inclusion, sustainability, and economic efficiency.

“In Latin America, where device renewal cycles exceed 36 months and the prices of new devices have increased by more than 30% in recent years, refurbishment is no longer a niche — it is becoming a category with solid fundamentals and strong growth potential,” said Stefan Krautwald, Managing Partner at Latin Leap VC.