Spin by OXXO® Strengthens Financial Inclusion with U.S.-to-Mexico Transfers

Spin by OXXO® enables near-instant transfers from the U.S. to Mexico through a new partnership, expanding access to digital remittances.

Spin by OXXO® continues to strengthen its commitment to financial inclusion by enabling a new way for people in Mexico to receive funds from the United States, offering a simpler, more accessible alternative to traditional remittance services.

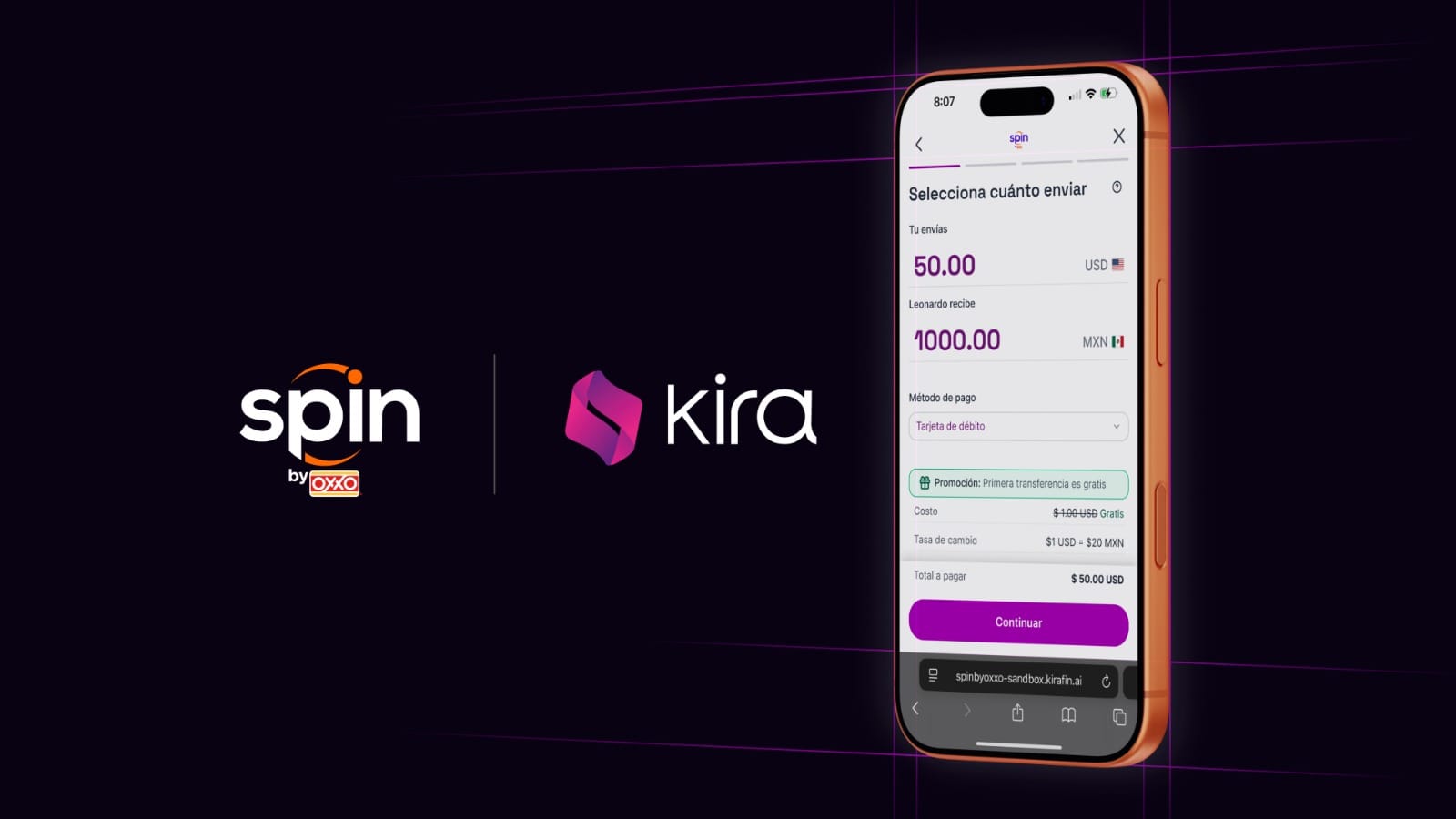

A new cross-border transfer option powered by Kira

As part of this initiative, Spin by OXXO® has integrated a new international transfer solution through a strategic collaboration driven by Kira, a technology platform that builds infrastructure for cross-border payments.

Through this integration, individuals in the United States can send money to Mexico using both digital and in-person channels, supported by registered and authorized entities in both countries.

The solution is designed with a user-centric approach, prioritizing a simple payment flow and near-instant delivery. It aims to reduce friction and barriers commonly associated with traditional remittance services, particularly for communities with limited access to formal financial tools.

Fast, app-free transfers for Spin by OXXO® users in Mexico

With this integration, anyone in Mexico who has a Spin by OXXO® account can receive funds from the United States in just a few minutes, without the need to download additional applications. Spin by OXXO® currently serves 9.9 million active users, expanding its reach within the digital financial ecosystem.

The process is straightforward: the recipient in Mexico generates a payment link directly from the Spin by OXXO® app and shares it via instant messaging. The sender then completes the transfer through Kira’s platform in just a few minutes.

Multiple ways to send money from the United States

Funds can be sent from the United States either in cash or using a debit card. Cash transfers can be completed at more than 90,000 authorized partner locations within Kira’s network across the U.S., offering flexibility for users who prefer in-person transactions.

This hybrid model, combining digital flows with physical access points, helps lower technological barriers and broadens access for users with varying levels of digital adoption.

Strengthening financial inclusion through accessible technology

“This integration represents another step in our commitment to strengthening financial inclusion in Mexico and delivering solutions that respond to real user needs,” said Ricardo Olmos, Director of Spin by OXXO®. “By enabling a new way to receive funds from the United States, we bring technology closer to people who have traditionally been excluded from the financial system, simplifying a process that directly impacts millions of families.”

From Kira’s perspective, the collaboration is rooted in addressing the real challenges faced by migrant communities.

“As an immigrant, I know how important it is to send support back home in a simple and dignified way,” said Beto Díaz, Co-founder of Kira. “This alliance with Spin by OXXO® brings real solutions to families that depend on remittances, making the process more accessible for everyone.”

An alternative designed for migrant communities

According to Banco de México, the country received a historic record of more than US$64 billion in remittances in 2024, sent by Mexican workers in the United States. These flows represent a critical source of income for millions of households, particularly in communities with limited access to financial services.

By introducing this new option, Spin by OXXO® positions itself as a more economical, accessible, and convenient alternative, allowing families to receive funds in minutes, without lines, and with 24/7 availability.

How funds can be used once received in Mexico

Once the funds are credited to a Spin by OXXO® account, users can withdraw cash at any of the more than 24,000 OXXO® stores across Mexico. Additionally, the balance can be used for in-store and online payments, transfers, mobile top-ups, and other everyday financial services.

Through this alliance, Spin by OXXO® strengthens its presence in the high-impact cross-border payment corridor between the United States and Mexico. This segment plays a critical social and economic role, and the integration further reinforces Spin by OXXO®’s digital financial ecosystem with solutions designed to meet the needs of underserved populations.