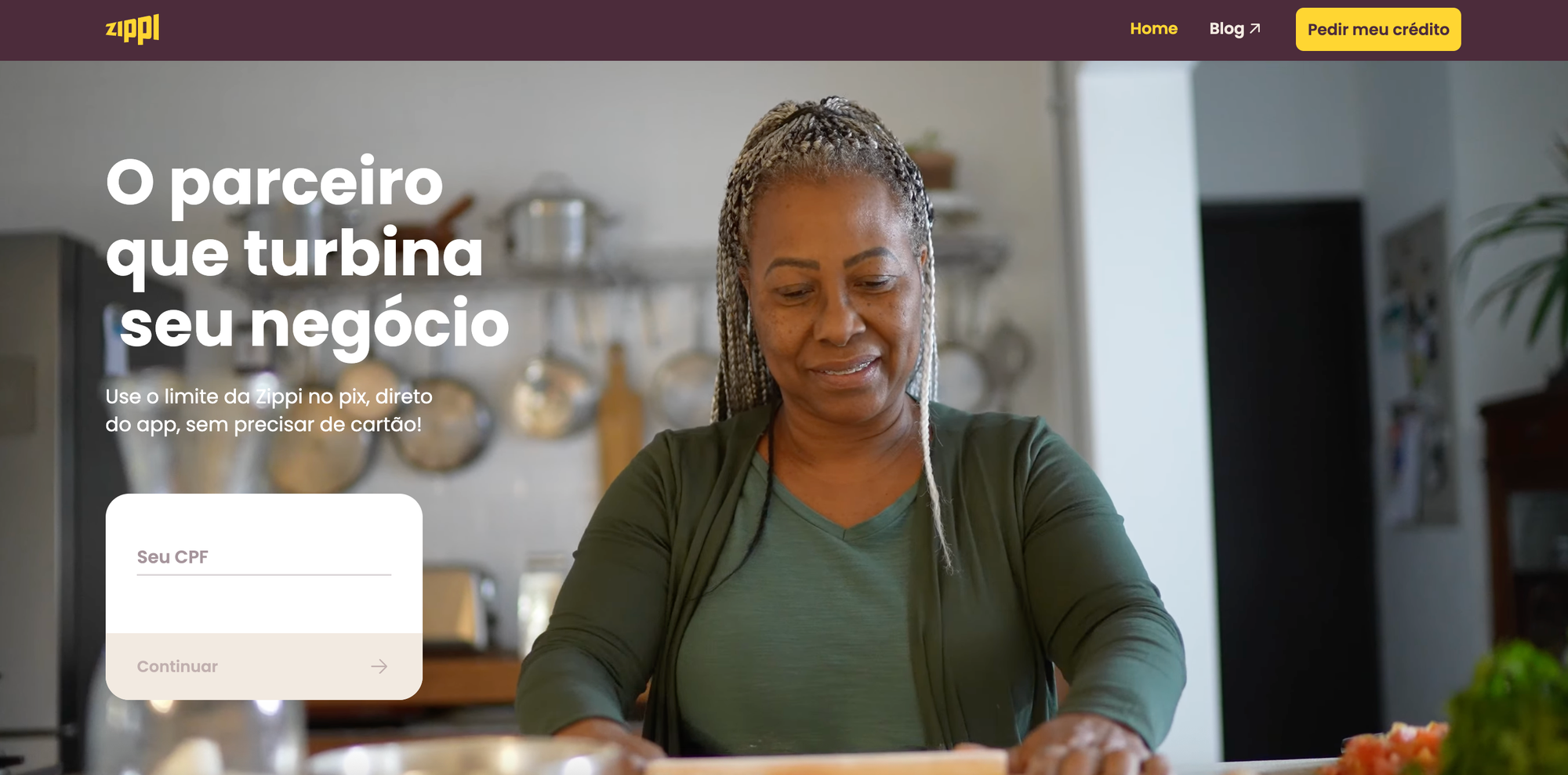

Zippi Raises USD$15.9M from Itaú and Verde Asset to Boost Credit for Small Businesses in Brazil

Brazilian fintech Zippi raises USD$15.9M from Itaú and Verde Asset to expand credit access, double lending, and invest in AI-driven financial services.

Zippi, a Brazilian fintech backed by Tiger Global, has raised USD 15.9 million (BRL 85 million) through a Credit Rights Investment Fund (FIDC) led by Itaú and Verde Asset. The financing round marks a significant milestone for the company as it works to broaden access to credit for entrepreneurs and small businesses across Brazil.

Expanding Financial Inclusion for Small Businesses

Founded with the mission to democratize access to credit, Zippi targets a segment often overlooked by traditional banks, Brazil’s 22 million micro and small enterprises. The fresh capital will allow the company to double its credit offering by the end of 2025, strengthening its portfolio that already includes over 100,000 active clients.

In 2024, Zippi managed BRL 80 million in assets and projects to reach BRL 160 million by 2025. The company sees this growth as a step toward becoming a key financial partner for small business owners who drive the country’s economic activity.

Institutional Support and Market Validation

The participation of Itaú and Verde Asset highlights the increasing institutional confidence in fintech innovation within emerging markets. Traditional investors are now turning to scalable models like Zippi’s, recognizing their potential to modernize financial access.

This round also aligns with broader regulatory shifts in Brazil, such as the Drex program led by the Central Bank, which encourages the tokenization of assets and the digital transformation of the country’s financial infrastructure.

Leveraging AI for Risk Management and Personalization

As part of its growth strategy, Zippi plans to integrate artificial intelligence to enhance risk management and tailor financial products to customer needs. By combining data-driven insights with responsible lending, the fintech aims to solidify its position as a trusted player in Brazil’s competitive financial ecosystem.