Mexico Leads Latin America in Venture Capital in H1 2025

Mexico has overtaken Brazil as the largest recipient of venture capital in Latin America, according to Q2 2025 data from LAVCA.

For the first time in over a decade, Mexico has overtaken Brazil as the largest recipient of venture capital in Latin America, according to Q2 2025 data from LAVCA. This milestone is driven by a surge of major funding rounds exceeding $50 million for Mexican startups, led notably by Klar’s record $190 million Series C round. Below is a deeper look at the top 10 companies fueling this shift.

Klar

Klar is a Mexico City–based digital banking platform that recently closed a $190 million Series C funding round led by U.S. private equity firm General Atlantic, with $170 million in equity and $20 million in venture debt, valuing the company above $800 million.

Founded in 2019, it now serves over two million users, offering mobile-first financial products such as credit cards, deposit accounts, loans, and investment services. Klar reported nearly $300 million in annual revenue and is targeting a $500 million run rate by Q3 2025, preparing for a potential IPO in the coming years .

Merama

Merama, founded in 2020, is a digital brand accelerator and e‑commerce aggregator operating across Mexico, Brazil, Chile, Colombia, and Peru. It partners strategically with category-leading merchants, offering capital, technology, marketing, and operational expertise to scale their online businesses.

In early 2025, it secured approximately $215 million in a mixed equity and debt financing round, adding to over $520 million in total capital raised to date. Merama views itself as a partner-driven ecosystem rather than a roll-up, selectively investing to help brands reach unicorn status.

VEMO

VEMO is a cleantech mobility company founded in 2021, offering EV leasing, public charging stations, and fleet management for sustainable transportation in Mexico. It recently secured MXN $500 million (~US $27 million) in long-term, asset-backed financing from BEEL Credit to expand its charging network from 1,200 to 2,200 connectors across 18 cities by the end of 2025. Previously, VEMO raised approximately $64 million in early 2025 to boost its fleet management and EV infrastructure capabilities.

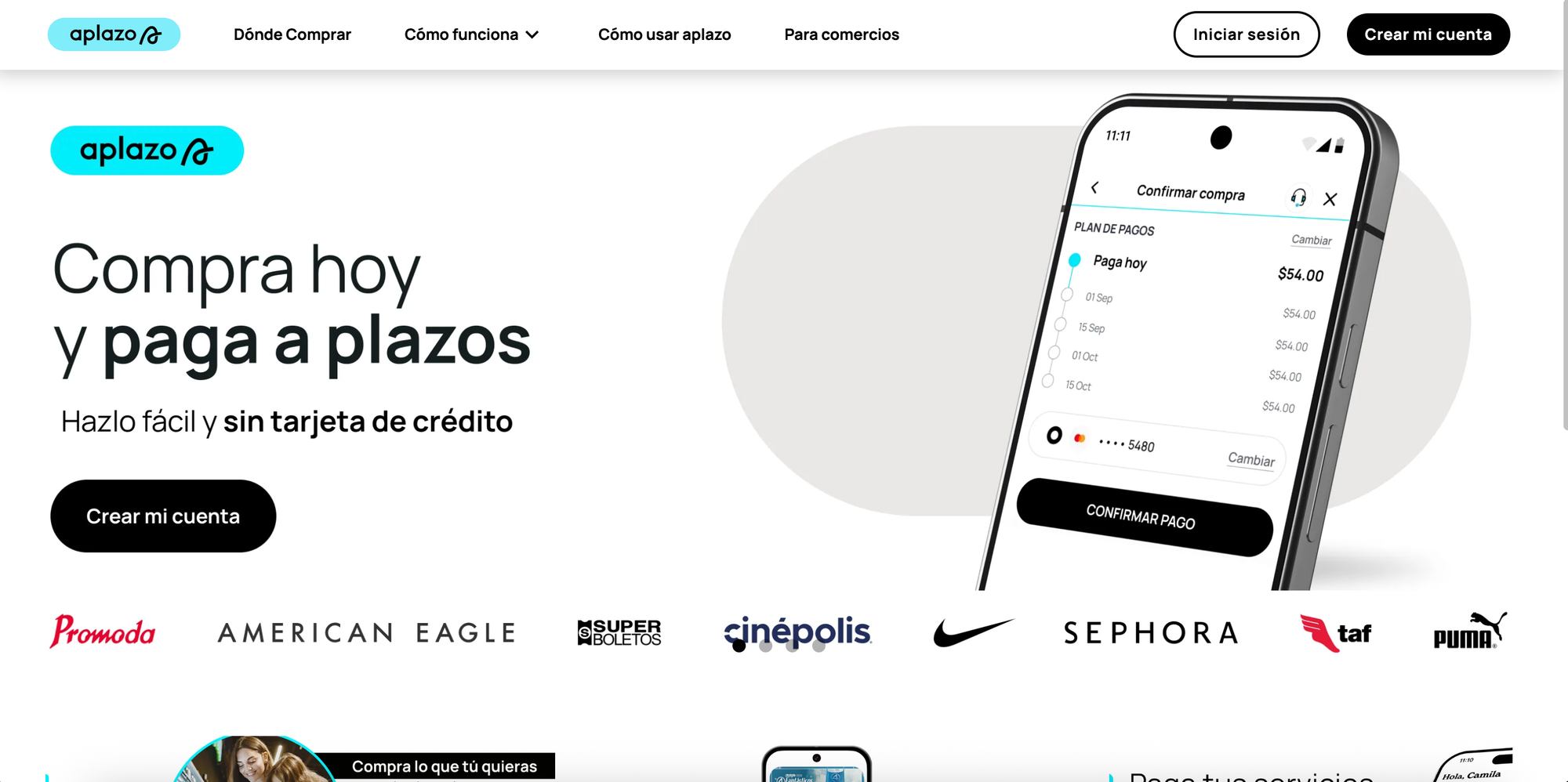

Aplazo

Aplazo operates a payment network designed to help merchants increase sales and build their brand through financial tools and installment payment options. While specific funding details weren't disclosed in the LinkedIn post, Aplazo is part of the emerging wave of fintech innovation in Mexico, offering seamless merchant solutions.

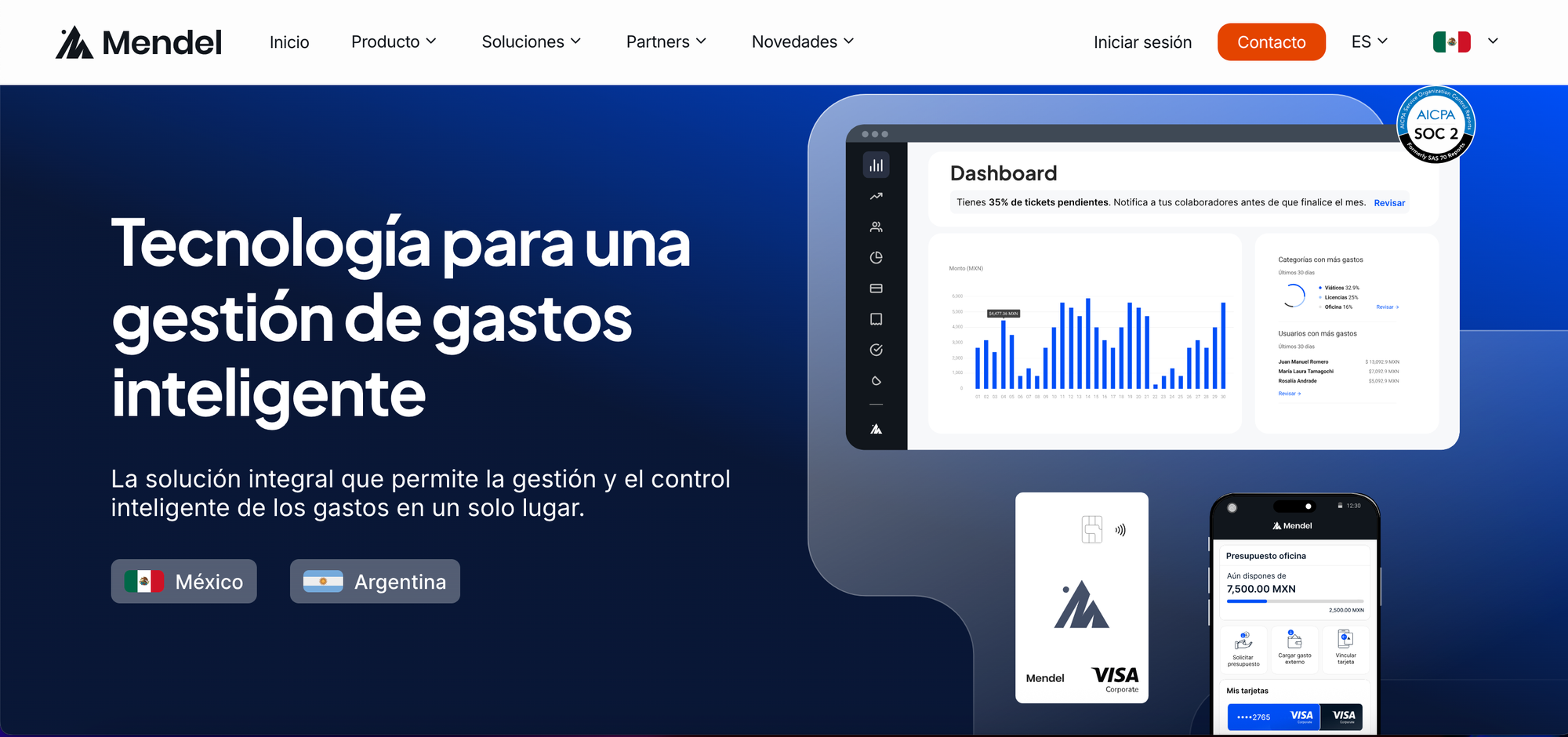

Mendel

Mendel provides a corporate expense management platform aimed at streamlining financial workflows for enterprises. It enables businesses to control spending, automate reimbursements, and manage budgets, all critical features in modern corporate operations, though detailed investment data remains undisclosed.

Plata Card

Plata Card is a fintech platform offering credit cards with custom rewards programs tailored to consumer behavior. It represents the growing demand for personalized financial products in Mexico’s expanding fintech landscape.

Xante

Xante is a Mexican PropTech company focused on affordable housing solutions. They facilitate the purchase and sale of pre-owned homes for low‑ and middle-income segments, addressing both financial inclusion and real estate access in underserved markets.

Vexi

Vexi develops finance and banking applications designed for seamless daily transactions in Mexico. Their digital-first approach supports smooth credit card and banking experiences for a digitally evolving population.

Belvo

Belvo is an open finance API platform enabling secure data connectivity between user bank accounts and financial applications. It plays a pivotal role in Latin America’s fintech infrastructure by powering data-driven financial services.

Félix

Félix is a chat‑based remittance platform empowering Latinos in the U.S. to send money internationally with ease and lower costs. Its conversational interface simplifies cross-border transfers, appealing to users seeking accessible and efficient remittance options.

Mexico’s rise as Latin America’s top venture capital destination in the first half of 2025 reflects its startup ecosystem's growing maturity and investor appeal. As Mexico continues pulling ahead, these companies are setting new standards for capital efficiency, strategic partnerships, and sectoral leadership across the region.